Insider Selling Signals a Need for Cash or a Tax Strategy? Silverstein Christine Berni sold 20,070 shares of Abeona Therapeutics on February 2, 2026, at an average price of $5.09—slightly above the current market close of $5.27. The filing notes that the proceeds were used to cover tax obligations linked to the vesting of restricted stock awards. While the transaction is modest relative to her total holdings (137,722 shares post‑sale), it raises questions about the company’s liquidity position and the personal tax strategies of its insiders. A pattern of selling tied to tax events is not uncommon, yet it can be perceived by investors as an indicator that insiders are not fully committed to long‑term upside.

What Does the Sale Mean for Investors? The trade occurs against a backdrop of a relatively flat share price, a 5.18 % weekly gain, and a 13.61 % year‑to‑date decline. Investors watching insider activity may interpret this sale as a neutral signal: the transaction is routine and unrelated to negative company developments. However, the simultaneous high buzz level (78.63 %) and negative sentiment (-32) suggest that social media chatter is amplifying concerns about insider liquidity and the company’s short‑term prospects. If insiders continue to sell for tax reasons, it could prompt the market to question whether the company has adequate cash reserves to fund its gene‑therapy pipeline.

Silverstein’s Historical Trading Pattern Berni’s past activity shows a single large purchase on January 26, 2026, acquiring 37,313 shares at $0.00—presumably a grant or vesting event—followed by the February sale. This sparse trading history indicates that she is a passive holder rather than an active trader. The lack of frequent buying or selling suggests that Berni is likely a shareholder who participates primarily in vesting events rather than in opportunistic market timing. Her current sale, aligned with tax obligations, fits this profile and reduces the likelihood that she is acting on insider information or a strategic divestment.

Company‑Wide Insider Activity Adds Context Other insiders, such as Donald Wuchterl and Eric Crombez, sold roughly 30,000 shares each on the same day, while Leila Alland and Mark Alvino also divested. These concurrent sales hint at a broader pattern of tax‑related liquidation rather than a coordinated sell‑off driven by negative news. Nevertheless, the cumulative effect of multiple insiders liquidating shares can create downward pressure on the stock, especially when the market is already weak.

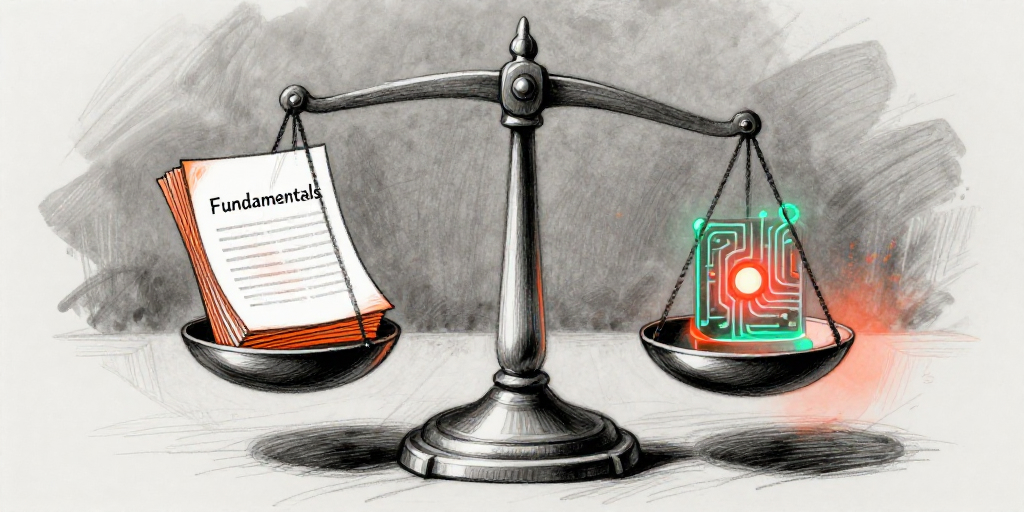

Strategic Outlook for Abeona Abeona remains a clinical‑stage biopharmaceutical with a modest market cap of $284 million and a P/E of 4.76, indicating a valuation that still offers upside potential. The company’s gene‑therapy pipeline and recent grant announcements suggest that it is investing heavily in long‑term research. Insider selling tied to tax events is unlikely to derail these strategic priorities. For investors, the key takeaway is that while insider sales can be a sign of liquidity needs or tax planning, they do not, in this instance, signal a fundamental shift in the company’s trajectory. Monitoring subsequent filings will be essential to determine whether insiders continue to sell or begin buying, which could provide a clearer indication of confidence in Abeona’s future.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-02-02 | Silverstein Christine Berni () | Sell | 20,070.00 | 5.09 | Common Stock |