Insider Buying Sparks Interest in TCI’s Real‑Estate Footprint

On January 12, 2026, American Realty Investors Inc. (ARL) purchased 70,023 shares of Transcontinental Realty Investors (TCI) common stock at $55.50 per share. The transaction—executed under a settlement of a 2025 litigation involving ABCLD—added to ARL’s already sizable stake of 1,383,226 shares held through its subsidiary. The buy raises the total ARL ownership to approximately 5.4 million shares, roughly 12% of TCI’s outstanding equity, and signals continued confidence in the company’s diversified real‑estate portfolio.

What the Purchase Means for Investors

The buy comes at a price only modestly above TCI’s closing price of $51.16 and follows a week of negative price movement (-4.62%). For investors, ARL’s willingness to acquire more shares at a premium suggests an expectation of future upside, perhaps driven by the company’s broad mix of apartments, office space, industrial assets, and mortgage lending. The transaction also coincides with a 16.43 % spike in social‑media buzz and a neutral sentiment score (-10), indicating that the market is reacting more to volume than to a change in perception. If the underlying asset values continue to climb, the premium paid could quickly turn into a profitable position for ARL and, by extension, its shareholders.

Implications for TCI’s Strategic Direction

TCI’s share price has traded between a 52‑week low of $25.50 and a high of $59.65, reflecting a 83.48% yearly gain despite recent volatility. The company’s price‑earnings ratio of 82.08 remains high relative to peers, implying that investors are pricing in significant growth potential. ARL’s enlarged stake may influence corporate governance, potentially pushing for more aggressive expansion or portfolio optimization. If ARL advocates for a higher dividend yield or a strategic sale of non‑core assets, TCI could see a shift toward more cash‑generating operations, which would likely be welcomed by income‑seeking investors.

Looking Ahead

With the market still navigating the aftermath of a broader real‑estate downturn, insider activity such as ARL’s purchase signals that seasoned investors are betting on TCI’s long‑term resilience. For retail and institutional investors alike, the key will be monitoring how the company leverages its diversified holdings to generate steady returns amid rising interest rates and shifting tenant demands. If TCI can maintain its portfolio quality while delivering incremental earnings, the recent insider buying may prove a harbinger of continued shareholder value creation.

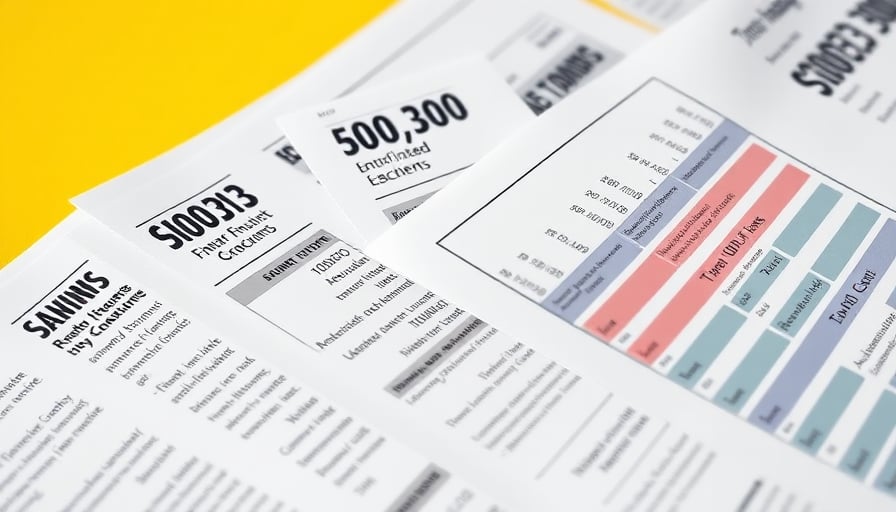

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-01-12 | AMERICAN REALTY INVESTORS INC () | Buy | 70,023.00 | 55.50 | Common Stock, par value $0.01 per share |

| N/A | AMERICAN REALTY INVESTORS INC () | Holding | 1,383,226.00 | N/A | Common Stock, par value $0.01 per share |