Insider Selling in a Volatile Nanotech Landscape

Aura Biosciences (AURA) has seen a modest yet notable sell‑off by its Senior Vice President of Finance, Amy Elazzouzi, on January 20, 2026. The transaction—1,581 shares at $4.86 each—was triggered automatically by the vesting of restricted stock units to cover tax withholding, rather than a discretionary decision. While the trade size is relatively small compared to the company’s market cap of roughly $319 million, it coincides with a broader wave of insider activity that has left the stock price hovering near its 52‑week low of $4.345.

What Investors Should Take Away

The sale, occurring at a time when AURA’s share price is down 18.66% year‑to‑date and trading near its lower end of a 62 % annual volatility range, may not signal a fundamental shift in management’s confidence. Instead, it reflects the routine tax‑management of a vesting event. However, the timing is noteworthy: the company’s last public update was in late 2025, and the market has yet to digest recent R&D progress in nanoparticle delivery. The simultaneous sell‑off by other insiders—most notably CEO Elisabet de los Pinos and CTO Mark Plavsic—adds a layer of caution for price‑sensitive investors. AURA’s negative P/E and modest price‑to‑book ratio underscore a valuation that is still heavily contingent on future milestones.

Elazzouzi’s Insider Profile

Amy Elazzouzi’s transaction history paints a picture of a cautious, compliance‑driven executive. Her two recent trades—one in October 2025 (896 shares at $6.35) and the current January sale—are both tax‑related vesting sales, suggesting a pattern of passive disposition rather than speculative selling. Her post‑transaction holdings remain substantial, at 84,081 shares, indicating continued long‑term interest. Unlike some peers who have purchased shares (e.g., Sapna Srivastava and David Michael Johnson), Elazzouzi has not engaged in buying, reinforcing the view that her primary role is financial stewardship rather than active market speculation.

Strategic Implications for AURA

For stakeholders, the key takeaway is that insider activity remains routine and largely driven by vesting schedules rather than earnings forecasts. Yet, the cluster of sales from multiple executives could be interpreted as a subtle signal of internal pressure to manage liquidity or a reaction to the company’s slowing revenue trajectory. In a sector where breakthrough patents and regulatory approvals dictate valuation, any hint of insider concern can amplify market volatility. As AURA pursues its nanotechnology pipeline, investors will likely monitor upcoming clinical milestones and regulatory filings more closely than the modest share sales that have characterized recent insider dealings.

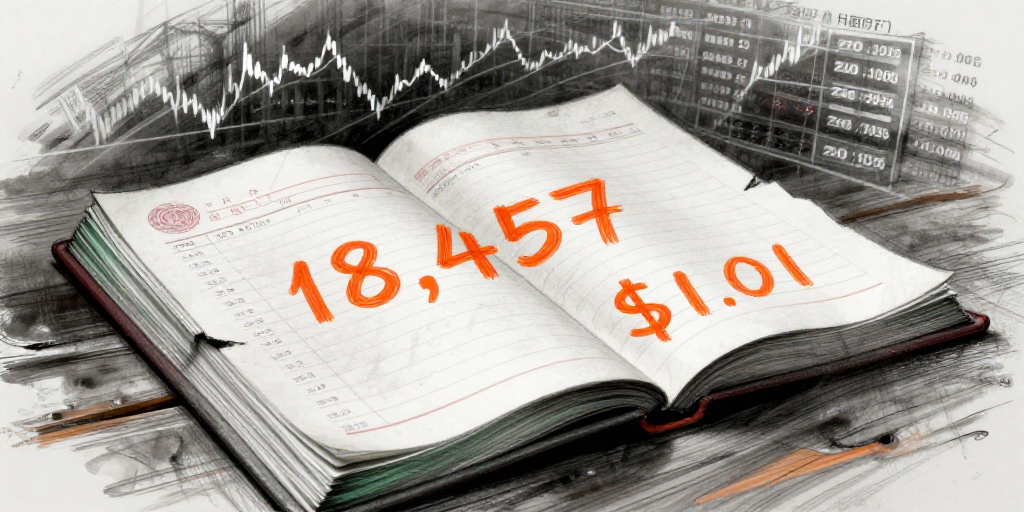

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-01-20 | Elazzouzi Amy (Senior Vice President, Finance) | Sell | 1,581.00 | 4.86 | Common Stock |