Insider Buying Spurs Optimism at Atmos Energy

On February 4, 2026, board member Sampson Richard A executed a sizable purchase of 30,808 shares of Atmos Energy’s common stock, followed by a second tranche of 685 shares on the same day. The acquisitions were priced at $171.62 per share, a level virtually unchanged from the market close of $171.83 on February 3, and resulted in a post‑transaction holding of roughly 41,082 shares. The transactions were reported as “buy” entries under the company’s Equity Incentive and Deferred Compensation Plan, with fractional shares rounded up to the nearest whole share—a common practice that can sometimes inflate the apparent number of shares acquired.

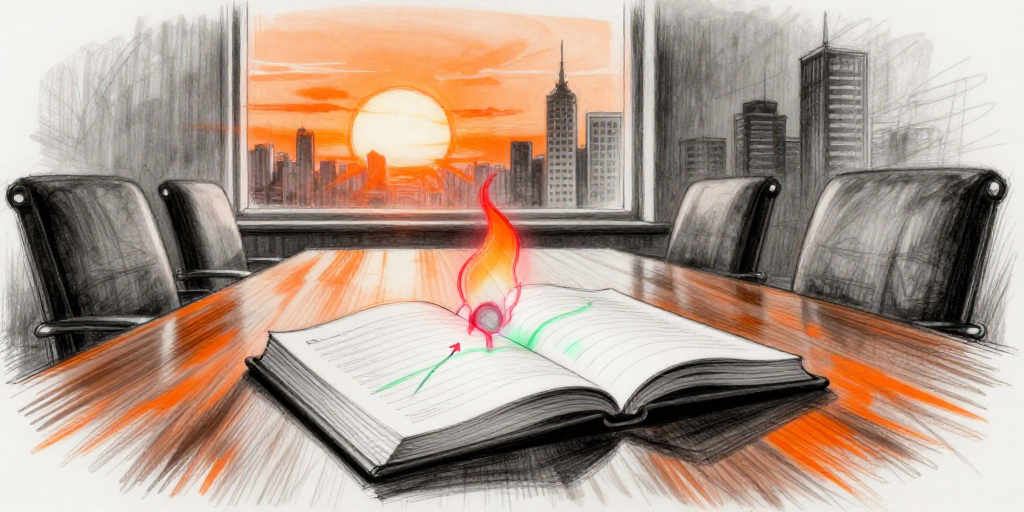

What the Trade Signals to Investors

The timing and size of the purchase suggest a bullish stance by an insider with direct governance responsibilities. Board members typically possess a long‑term perspective, and their willingness to add to their positions can be interpreted as a confidence vote in the company’s trajectory. The transaction occurs amid a backdrop of strong quarterly performance—Atmos Energy’s recent earnings have delivered a 19.84% yearly gain, and the stock has trended upward with a 2.87% weekly increase. The buy aligns with a broader pattern of insider buying, as seen in the February 3 filings where several senior executives, including the CEO and CFO, secured large restricted‑stock units. Such activity may reinforce the narrative that management believes the current valuation is attractive and that the company’s pipeline and storage assets will continue to generate value.

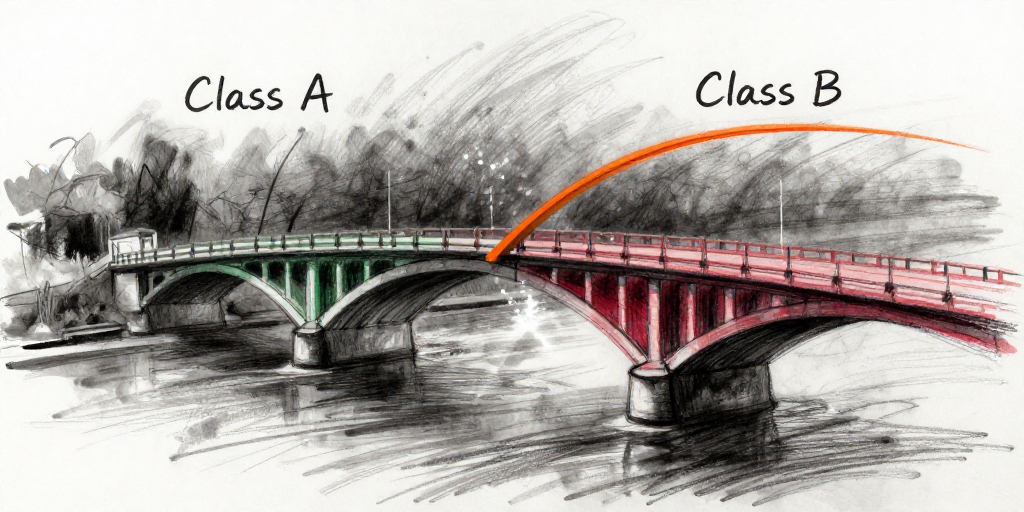

Implications for Shareholders and Valuation

For shareholders, insider purchases can serve as a positive signal, potentially supporting the stock’s momentum. However, the scale of the trade—about 30,000 shares—constitutes only a modest fraction of Atmos Energy’s total outstanding shares, given a market cap of roughly $28.4 billion. Therefore, while the gesture is encouraging, it is unlikely to exert significant downward pressure on the share price in the short term. Over the longer horizon, continued insider buying—especially when paired with robust earnings and strategic investments in gas infrastructure—could justify a higher valuation multiple. Atmos Energy’s price‑earnings ratio of 22.1 sits comfortably within the industry median for gas utilities, suggesting that the market may still have room to reward future growth.

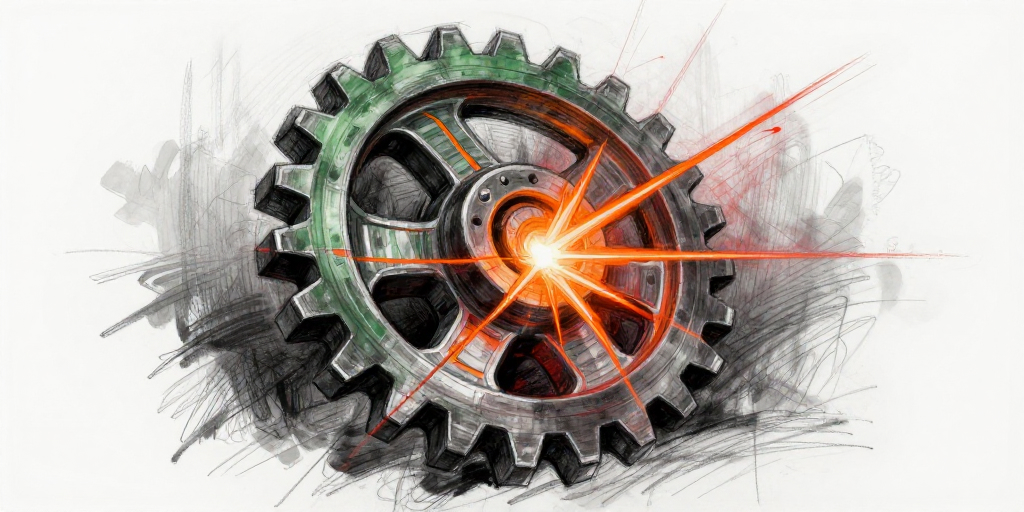

Broader Context and Market Sentiment

Social media sentiment around the filing is notably positive, with a +39 score and a buzz level of 63 %. Although these metrics are not directly linked to fundamental value, they reflect a healthy investor conversation that may contribute to short‑term liquidity. The company’s recent strategic initiatives—expanding storage capacity, modernizing pipeline assets, and pursuing decarbonization projects—align with regulatory trends and consumer demand for cleaner energy. As Atmos Energy continues to navigate the evolving utilities landscape, insider confidence, as demonstrated by Sampson’s purchase, will be an important barometer for analysts and investors alike.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-02-04 | Sampson Richard A () | Buy | 30,808.00 | 171.62 | Common Stock |

| 2026-02-04 | Sampson Richard A () | Buy | 685.00 | 171.62 | Common Stock |

| 2026-02-04 | Sampson Richard A () | Sell | 30,808.00 | N/A | Phantom Stock Units |

| 2026-02-04 | Sampson Richard A () | Sell | 685.00 | N/A | Phantom Deferred Compensation |