Insider Grants and the Pulse of Carlisle’s Leadership

Selbach Scott C, the executive vice‑president of government relations and secretary, has just received a grant of 2,055 restricted shares on 28 January 2026. The allocation, issued at no cash cost, bumps his holdings to 87,422 shares—roughly 0.58 % of the outstanding equity. While the transaction is modest in size, it signals continued confidence from a senior executive who sits on the board and oversees critical stakeholder relationships. In a company that recently traded around $341, the grant represents an alignment of executive incentives with shareholder value, especially as Carlisle has maintained a stable dividend policy and a steady earnings profile.

A Broader Wave of Insider Activity

That same day, Chairman and CEO Christian Koch executed a sizeable purchase of 8,730 common shares, bringing his stake to 108,399 shares. The simultaneous activity of multiple insiders—including the acquisition of employee stock options by Koch and the purchase of deferred stock units by other executives—suggests a concerted effort to reinforce long‑term equity ownership. For investors, these moves reinforce a narrative that the leadership team is not merely holding cash but is willing to stake personal capital in the company’s trajectory. This can be interpreted as a vote of confidence, particularly in a sector where cyclical downturns and supply‑chain disruptions can erode investor sentiment.

Implications for Investors and Future Outlook

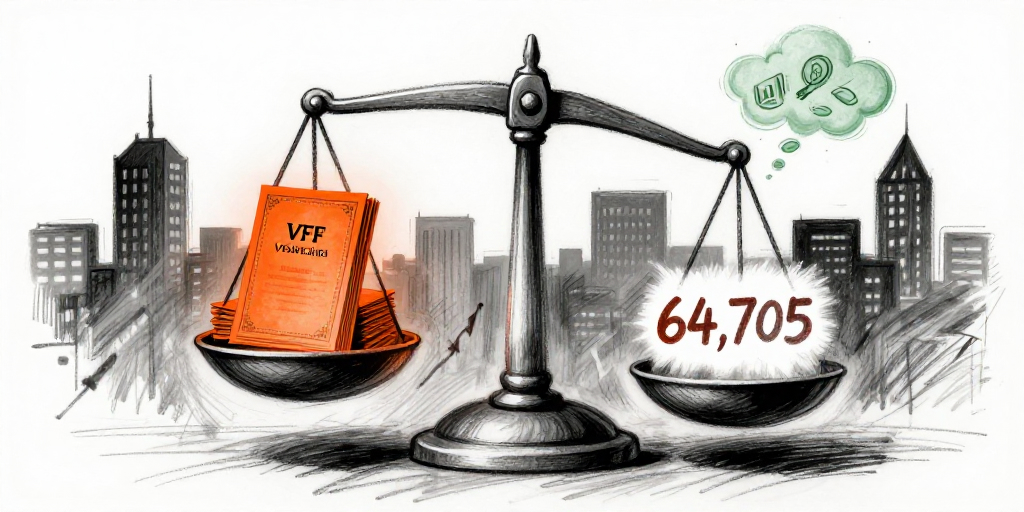

From a valuation standpoint, Carlisle’s price‑to‑earnings ratio sits at 20.03, comfortably within the industry average for industrial conglomerates. The recent 5.36 % weekly decline and a 13.03 % yearly drop are offset by a 4.48 % monthly gain, indicating a relatively resilient performance in the face of broader market volatility. The insider purchases—especially by the CEO—may act as a stabilizing factor for the stock, potentially tempering short‑term volatility. Moreover, the company’s diversified product mix, spanning construction materials to transportation components, positions it to weather sector‑specific downturns.

Strategic Considerations Moving Forward

Carlisle’s leadership appears to be reinforcing a long‑term strategic vision rather than pursuing short‑term gains. The grant of restricted shares to Selbach, coupled with the CEO’s substantial equity purchases, signals a commitment to aligning executive pay with shareholder returns. For investors, this could translate into a more disciplined capital allocation strategy, potentially reflected in future capital expenditures or share repurchases. As the company continues to navigate post‑pandemic supply chain challenges and shifting construction demand, these insider actions may serve as a reassuring sign of management’s confidence in the company’s growth prospects.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-01-28 | Selbach Scott C (Exec VP, Govt Relations & Secy) | Buy | 2,055.00 | N/A | Common Stock |

| 2026-01-28 | KOCH D CHRISTIAN (Chair, President & CEO) | Buy | 8,730.00 | N/A | Common Stock |

| N/A | KOCH D CHRISTIAN (Chair, President & CEO) | Holding | 135,000.00 | N/A | Common Stock |

| 2026-01-28 | KOCH D CHRISTIAN (Chair, President & CEO) | Buy | 30,555.00 | N/A | Employee Stock Option (Right to Buy) |