Insider Confidence Amid Market Volatility

On January 28, 2026, Schwar Stephen, Vice Chair of the Board of Carlisle Companies Inc., executed a sizeable purchase of 990 common shares—an act that, combined with a contemporaneous 3,465‑share employee stock option grant, signals a bullish stance on the company’s trajectory. The transaction occurred just a day after a modest 0.01 % dip in the share price, with the market closing at $341.01. Despite a weekly decline of 5.14 % and a yearly slide of 12.83 %, the high buzz (175 % relative to average) and upbeat sentiment (+57) suggest that investor chatter is far from negative. In the context of Carlisle’s diversified industrial footprint—ranging from roofing to aircraft equipment—the insider buy appears to be a calculated bet on the company’s ability to capitalize on its broad product mix.

A Cohesive Insider Buying Wave

The recent wave of insider purchases is not an isolated event. Earlier in the year, Chairman‑CEO D. Christian Koch and other senior executives such as Executive VP Scott Selbach and President K. Taylor made significant acquisitions, with Koch alone buying 8,730 shares and a block of employee options. Meanwhile, the board’s other members—Palmer, Singh, and Ricard—have been steadily accumulating both restricted and deferred units. This synchronized buying spree underscores a shared conviction that Carlisle’s operational moat, driven by its robust supply chain and cross‑sector presence, will translate into sustained earnings growth. For investors, the alignment of leadership and ownership is a classic signal that the company’s management believes its prospects are undervalued or poised for a breakout.

Implications for Investors

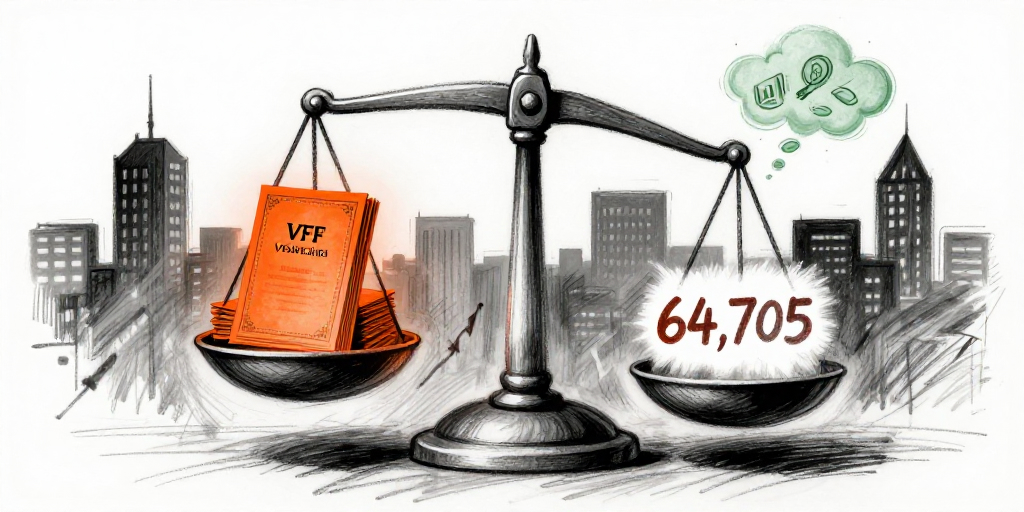

From an investment standpoint, the insider activity points to a few key takeaways. First, the accumulation of shares by senior executives suggests confidence that Carlisle’s stock price will rebound from its current low of $293.43 (52‑week low) toward its high of $435.92 (52‑week high). Second, the sizeable option grant, vesting over three years, aligns long‑term incentives with shareholder value, potentially curbing short‑term volatility. Finally, the company’s stable fundamentals—P/E of 20.03, a market cap of $14.97 billion, and a diversified portfolio—provide a solid backdrop for this optimism. Analysts may therefore view the insider purchases as a bullish endorsement, warranting a closer look at Carlisle’s upcoming earnings guidance and strategic initiatives.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-01-28 | Schwar Stephen (Vice Chair of CCM) | Buy | 990.00 | N/A | Common Stock |

| 2026-01-28 | Schwar Stephen (Vice Chair of CCM) | Buy | 3,465.00 | N/A | Employee Stock Option (Right to Buy) |