Insider Selling at a Low – What It Means for Applied Energetics

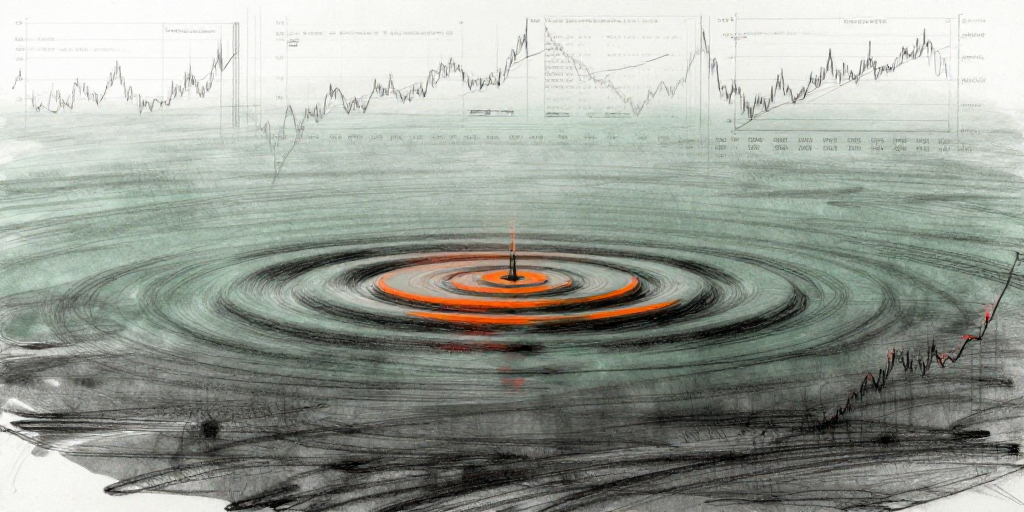

A recent 4‑form filing shows President & CEO Christopher Wayne sold 10,000 shares of Applied Energetics (AERG) on January 26, 2026, for an average of $1.65 per share – a modest $0.15 above the market close of $1.60. The sale comes after a series of smaller divestments over the past year (e.g., $1.93‑price sales in late 2025) and sits against a backdrop of a steep 52‑week decline that has taken the stock below its 2025‑06 high of $2.99. In an industry where cash flow is tightly linked to defense contracts, such a sale could be interpreted in a few ways. First, Wayne’s consistent “hold” positions in large blocks of incentive stock options (1 million shares) and RSUs (100,000 shares) suggest a long‑term stake that remains intact. The 10,000‑share sale, therefore, may simply represent portfolio rebalancing rather than a red flag. Second, the sale timing – after a modest uptick in the share price – may indicate a tactical move to lock in gains before further volatility in the defense‑sector market.

Investor Takeaway: Confidence or Caution?

From a value‑investor perspective, the insider transaction does not materially alter the risk profile. Wayne continues to hold a significant equity block, and his option grants vest on revenue milestones that are currently unachieved. The company’s negative P/E and P/B ratios underline a valuation that is far below intrinsic expectations, yet the ongoing contract pipeline in lasers and high‑voltage electronics could provide upside if capital constraints are resolved. For short‑term traders, however, the sale could signal an impending consolidation in AERG’s share price as insiders trim positions. The broader insider activity shows other executives (e.g., Stephen McCahon) also selling, suggesting a potential trend of liquidity management rather than a coordinated divestiture.

Who is Christopher Wayne? A Brief Profile

Christopher Wayne has been the face of Applied Energetics since 2022, steering the company through a series of strategic pivots toward advanced optics and guided‑energy systems. His insider history is dominated by option holdings that vest upon revenue milestones, indicating a strong incentive structure tied to business growth. Over the past two years, he has sold roughly 20,000 shares at prices ranging from $1.50 to $1.93, a pattern that reflects a disciplined, long‑term investment approach. The 10,000‑share sale on January 26 is consistent with this pattern, suggesting that Wayne is not disengaging from the company but rather fine‑tuning his portfolio in response to market dynamics.

Looking Ahead: What Investors Should Watch

- Revenue Milestones: Wayne’s option vesting is tied to $10 million, $25 million, and $50 million revenue targets. Achieving these milestones would unlock significant shares and could buoy the stock if market sentiment turns positive.

- Defense Contract Pipeline: The company’s core products—lasers and high‑voltage electronics—remain in demand amid geopolitical tensions. Monitoring new contracts or upgrades could signal a turnaround.

- Capital Structure: With a market cap of roughly $358 million and negative earnings, applied energetics will need to manage debt and cash flow carefully. Any moves to raise capital or refinance could impact insider holdings.

In sum, Christopher Wayne’s recent sale is a small adjustment within a broader strategy of maintaining a sizable equity stake while managing liquidity. For investors, the key will be to track how the company’s revenue targets and defense contracts evolve, as these will ultimately determine whether the insider confidence translates into a long‑term stock rally.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-01-26 | Donaghey Christopher Wayne (President & CEO/Principal AO) | Sell | 10,000.00 | 1.65 | Common Stock, par value $0.001 per share |

| N/A | Donaghey Christopher Wayne (President & CEO/Principal AO) | Holding | 1,000,000.00 | N/A | Incentive Stock Options |

| 2032-07-13 | Donaghey Christopher Wayne (President & CEO/Principal AO) | Holding | 1,000,000.00 | N/A | Incentive Stock Options |

| 2029-04-29 | Donaghey Christopher Wayne (President & CEO/Principal AO) | Holding | 150,000.00 | N/A | Non-Statutory Stock Options |

| 2029-04-29 | Donaghey Christopher Wayne (President & CEO/Principal AO) | Holding | 200,000.00 | N/A | Options |

| N/A | Donaghey Christopher Wayne (President & CEO/Principal AO) | Holding | 100,000.00 | N/A | Restricted Stock Units |