Insider Buying Signals from Andersons’ CEO

Krueger William E., the president and CEO, has just executed a modest purchase of 56 shares on January 23, 2026, using a price of $61.25 per share – a nominal $56.16 outlay. While the trade size is small relative to his overall stake (over 443 k shares post‑transaction), it reflects a continued confidence in the company’s near‑term outlook. The move comes a day after the stock closed at $60.20, and the price has been on a steady weekly climb of 1.6 %, matching a 13 % month‑to‑date gain and a 44 % year‑to‑date rally. Given Andersons’ high‑end consumer‑staples positioning, the CEO’s purchase, though incremental, can be interpreted as a subtle endorsement of the upcoming Q4 earnings announcement slated for February 17.

Implications for Investors and the Company’s Future

The CEO’s buy aligns with a broader trend of insider activity in the company: while a few executives have sold shares in December 2025, the overall trend is net buying. Douglas Gary A., a key board member, added 30 shares at $61.25, further bolstering sentiment. The positive social‑media buzz (Buzz = 150 %) and a net sentiment score of +44 suggest that market participants are taking notice of these insider moves, potentially amplifying short‑term liquidity and reinforcing a bullish narrative. For investors, the combined insider buying signals that management believes the stock is fairly valued or undervalued at current levels, especially considering the company’s robust 52‑week range and a price‑earnings ratio of 27.9 – comfortably below the industry average for consumer staples. The upcoming earnings release will test whether the market’s optimism translates into better-than‑expected results, potentially driving the share price toward its 52‑week high of $62.10.

Krueger William E. – A Profile Based on Historical Trades

Krueger’s insider history is marked by large December 2025 transactions: a sell of 38,200 shares on December 16, followed by a holding of 36,200 shares on the same day. These moves reduced his stake from roughly 443 k to 36 k shares, a drastic shift that may have been driven by liquidity needs or a strategic rebalancing of his portfolio. Since then, his holdings have recovered, culminating in the 443 k shares recorded after the January 23 buy. This pattern suggests a pragmatic approach: Krueger occasionally liquidates significant positions but remains a long‑term supporter, as evidenced by his sizable post‑transaction stake and recent purchase. His buying activity in January, coupled with his leadership role, indicates a belief that the company’s fundamentals—food & staples distribution, railcar leasing, and retail operations—will sustain growth and generate shareholder value in the near to medium term.

What to Watch Going Forward

- Q4 Earnings Release (Feb 17) – Watch for guidance on revenue, margins, and capital expenditures. Positive surprises could trigger a breakout toward the 52‑week high.

- Insider Transaction Patterns – Continue monitoring Krueger and other key executives for large buy/sell blocks that may presage strategic shifts or capital allocation decisions.

- Market Sentiment and Buzz – The elevated social‑media buzz suggests heightened interest; sustained positive sentiment could translate into short‑term momentum, but investors should remain vigilant to avoid over‑reliance on social signals.

In summary, Andersons’ CEO’s modest purchase, set against a backdrop of overall insider buying and a solid earnings trajectory, provides a cautiously optimistic signal for investors. The company’s strong fundamentals, upcoming earnings report, and the CEO’s continued support position Andersons as a potentially attractive holding in the consumer‑staples sector, particularly for those seeking exposure to the agricultural distribution and retail subsectors.

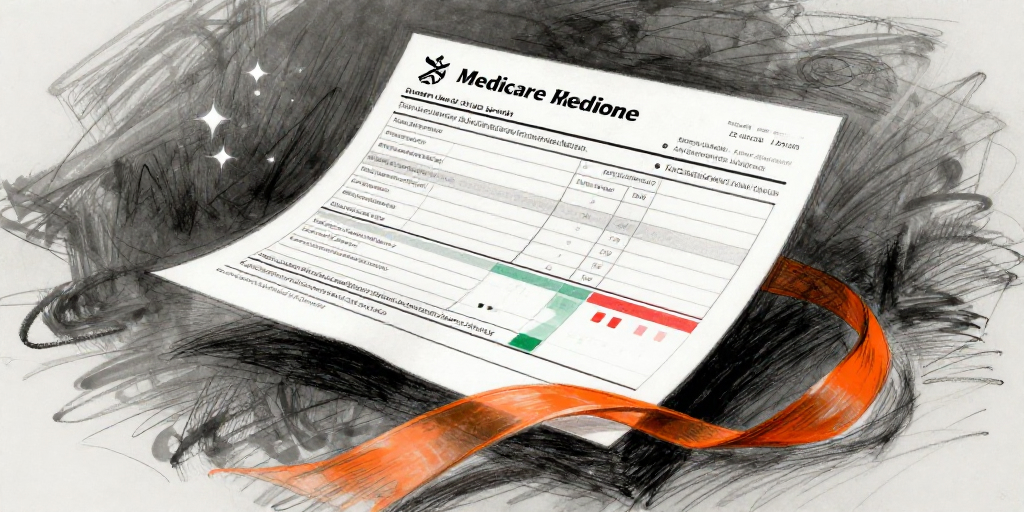

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-01-23 | Krueger William E. (President and CEO) | Buy | 56.16 | 61.25 | Common Stock |

| N/A | Krueger William E. (President and CEO) | Holding | 443,339.00 | N/A | Common Stock |

| 2026-01-23 | Douglas Gary A. () | Buy | 29.99 | 61.25 | Common Stock |