Insider Buying Signals a Strong Confidence in Monolithic Power Systems

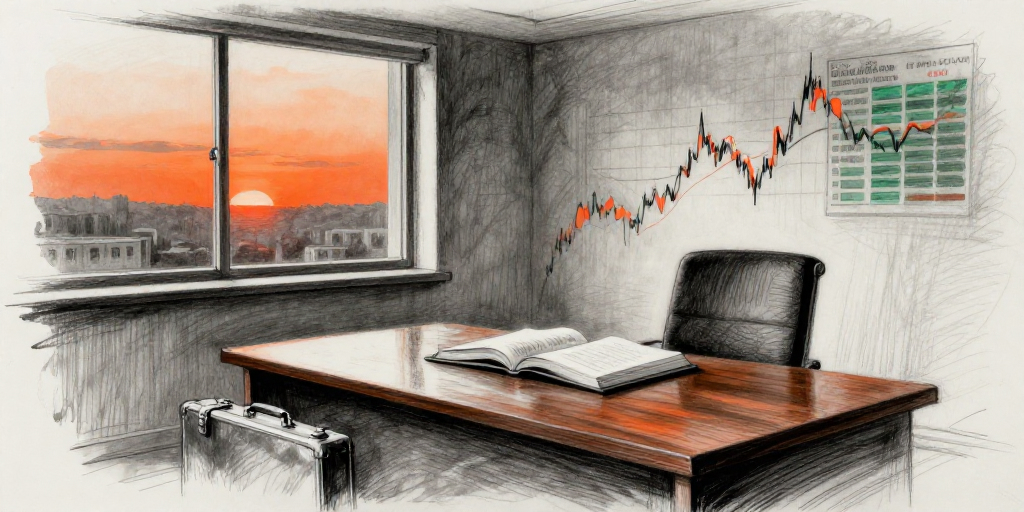

Monolithic Power Systems (MPS) saw its CEO, Hsing Michael, add 136,825 shares to his portfolio on February 3, 2026 – a “buy” transaction that comes just after the company’s latest quarterly results are due. The purchase was triggered by the vesting of performance‑based restricted stock units awarded in February 2023, and the shares were acquired at the market price of $1,158.89. With a price change of only +0.02 % and a current close of $1,136.83, the deal represents a strategic, long‑term stake rather than a speculative play.

What Investors Should Take Away

The timing of the purchase is telling. MPS is positioned in the high‑growth semiconductor space, and its recent earnings beat has nudged analysts to lift price targets. The CEO’s buy, combined with the strong social‑media sentiment (+81) and a buzz spike of 927 % around the filing, suggests that insiders are convinced the company is on a sustainable upward path. While the transaction size is modest relative to the CEO’s holdings (over 1 million shares), it is an encouraging sign that the top executive believes the current valuation underestimates future growth potential – especially as demand for power‑management chips in automotive and AI applications remains robust.

A Profile of Hsing Michael

Hsing Michael’s trading history paints a picture of a cautious yet opportunistic insider. In the past 12 months he has sold a total of roughly 1.4 million shares, often at or above market price, and bought back large blocks during periods of strong performance. His most recent sale of 121,918 shares on October 30, 2025, followed a high‑price rally, while his 136,825‑share purchase in February 2026 reflects confidence in the company’s trajectory. The CEO’s pattern of buying after performance milestones and selling when the stock peaks is consistent with a “buy‑when‑it‑matters” strategy, reinforcing that his actions are driven by long‑term value rather than short‑term speculation.

Implications for the Company’s Future

MPS’s market cap of $54.4 billion and a P/E of 29.22 place it comfortably in the growth‑equity space. The CEO’s recent purchase, coupled with the company’s projected earnings surge in the next quarter, suggests that insider confidence is aligned with market expectations. For investors, this could be a green light to increase exposure, particularly if the company’s Q4 results confirm the upward trend. On the other hand, the CEO’s substantial selling activity in the past year indicates he is actively managing risk and may continue to trim positions if the market becomes volatile. Overall, the insider activity signals a balanced view: a conviction in MPS’s core business while remaining vigilant to market dynamics.

Conclusion

Hsing Michael’s February 2026 buy, set against a backdrop of strong earnings prospects and robust insider confidence, offers a positive signal for MPS investors. The CEO’s trading pattern—selling in the wake of highs and buying post‑milestones—suggests a disciplined, long‑term approach. As the company heads into its next earnings release, the combination of insider backing and industry tailwinds may reinforce a bullish outlook, though prudent investors should monitor both the CEO’s continued trading and broader market sentiment.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-02-03 | Hsing Michael (CEO) | Buy | 136,825.00 | N/A | Common Stock |

| N/A | Hsing Michael (CEO) | Holding | 133,040.00 | N/A | Common Stock |

| N/A | Hsing Michael (CEO) | Holding | 12,825.00 | N/A | Common Stock |

| 2026-02-03 | Sciammas Maurice (EVP, WW Sales & Marketing) | Buy | 57,170.00 | N/A | Common Stock |

| N/A | Sciammas Maurice (EVP, WW Sales & Marketing) | Holding | 1,699.00 | N/A | Common Stock |

| N/A | Sciammas Maurice (EVP, WW Sales & Marketing) | Holding | 2,000.00 | N/A | Common Stock |

| N/A | Sciammas Maurice (EVP, WW Sales & Marketing) | Holding | 1,299.00 | N/A | Common Stock |

| N/A | Sciammas Maurice (EVP, WW Sales & Marketing) | Holding | 49,460.00 | N/A | Common Stock |

| N/A | Sciammas Maurice (EVP, WW Sales & Marketing) | Holding | 26,660.00 | N/A | Common Stock |

| N/A | Sciammas Maurice (EVP, WW Sales & Marketing) | Holding | 1,699.00 | N/A | Common Stock |

| N/A | Sciammas Maurice (EVP, WW Sales & Marketing) | Holding | 4,015.00 | N/A | Common Stock |

| N/A | Sciammas Maurice (EVP, WW Sales & Marketing) | Holding | 5,000.00 | N/A | Common Stock |

| N/A | Sciammas Maurice (EVP, WW Sales & Marketing) | Holding | 1,000.00 | N/A | Common Stock |

| N/A | Sciammas Maurice (EVP, WW Sales & Marketing) | Holding | 1,699.00 | N/A | Common Stock |

| N/A | Sciammas Maurice (EVP, WW Sales & Marketing) | Holding | 1,499.00 | N/A | Common Stock |