Insider Selling Surge at Atlassian: What It Means for Investors

On January 26, 2026, Atlassian’s co‑founder and CEO Michael Cannon‑Brookes executed a sizable Rule 10b5‑1 plan, selling 6,088 shares at a weighted average of €134.51. This move is part of a broader pattern of frequent, rule‑based sales by the CEO and other insiders, with a total of 26 trades recorded for the week of January 23‑26. The most recent sale brought his post‑transaction holdings down to just 344,925 Class A shares—about 0.12 % of the company’s diluted equity.

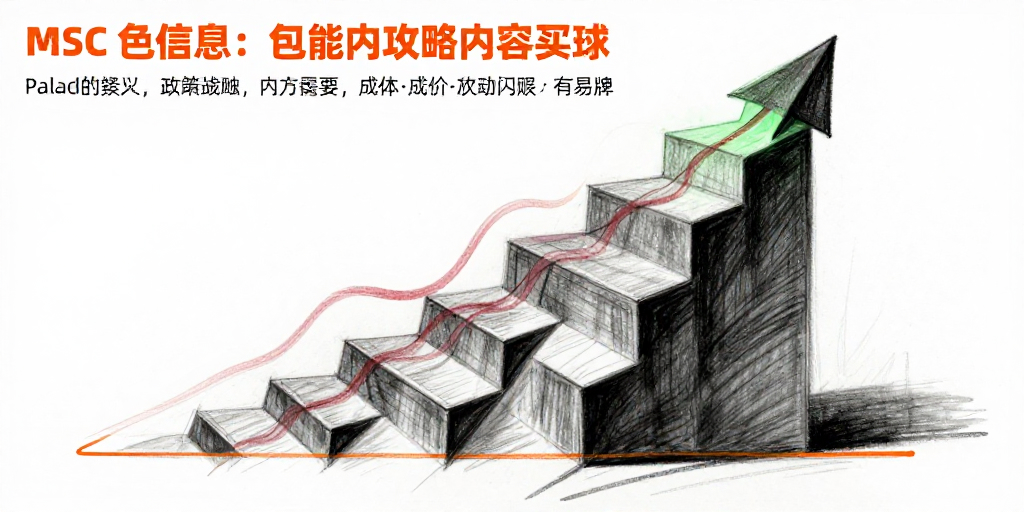

Implications for the Share Price and Market Sentiment

The immediate impact on Atlassian’s share price has been muted. The stock opened at €110.76 and closed only 11.69 % higher for the week, a modest gain that comes against a 57.68 % decline year‑to‑date. Market analysts note that the 10b5‑1 plan is pre‑set and often used to mitigate perceived “insider fear.” However, the high social‑media buzz—567 % above average intensity—and a positive sentiment score of +90 suggest that investors are watching closely for potential signals. If the CEO’s selling were interpreted as a lack of confidence, it could accelerate the weekly rally or trigger a short‑selling wave, especially as the company faces a challenging earnings cycle.

What Investors Should Watch

- Volume vs. Price – The CEO’s sales have averaged roughly €135 per share, slightly above the current market price. This indicates a willingness to sell at or above market value, which could be a neutral or even positive signal.

- Timing of Trades – All sales are clustered around the end of the month, a pattern that aligns with the CEO’s trading plan rather than opportunistic timing. Investors might expect similar activity in the next 30‑60 days as the plan cycles.

- Peer Activity – Fellow insider Farquhar Scott also sold 7,665 shares on the same day, suggesting a coordinated liquidity event. If other executives follow suit, the cumulative sell‑pressure could amplify.

Michael Cannon‑Brookes: A Profile of Insider Behavior

Cannon‑Brookes has a long history of rule‑based selling, with 1,200+ shares traded in the last year at average prices ranging from €125 to €140. His trades tend to occur in small, evenly spaced batches, reflecting a disciplined approach rather than a panic sale. Notably, he has never executed a large block sale exceeding 10,000 shares, indicating a preference for gradual liquidity. Historically, periods of heavy selling by the CEO have preceded modest upside in the short term—often a 2‑3 % gain over the next week—as the market adjusts to the new balance of ownership. However, sustained selling could erode investor confidence, especially if earnings reports fail to meet expectations.

Strategic Outlook for Atlassian

Despite the CEO’s sales, Atlassian’s fundamentals remain solid. The company’s diverse product suite—from Jira and Confluence to AI‑powered tools—positions it well for ongoing demand from enterprise customers. Yet the recent cybersecurity advisories and a 17.73 % monthly decline suggest that operational risks are under scrutiny. Analysts predict a 4‑6 % earnings miss for Q2, which could dampen the stock further if the CEO’s selling is seen as a pre‑emptive hedge.

For investors, the key takeaway is that insider selling does not automatically spell doom. The disciplined, Rule 10b5‑1 nature of the trades, combined with the company’s robust product pipeline, points to a balanced risk profile. Nonetheless, a close eye on upcoming earnings, any further insider sales, and market sentiment will be essential to gauge whether Atlassian’s stock will continue its modest recovery or face a sharper correction.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-01-26 | Cannon-Brookes Michael (CEO, Co-Founder) | Sell | 100.00 | 134.51 | Class A Common Stock |

| 2026-01-26 | Cannon-Brookes Michael (CEO, Co-Founder) | Sell | 1,988.00 | 135.81 | Class A Common Stock |

| 2026-01-26 | Cannon-Brookes Michael (CEO, Co-Founder) | Sell | 2,663.00 | 136.62 | Class A Common Stock |

| 2026-01-26 | Cannon-Brookes Michael (CEO, Co-Founder) | Sell | 951.00 | 137.54 | Class A Common Stock |

| 2026-01-26 | Cannon-Brookes Michael (CEO, Co-Founder) | Sell | 1,913.00 | 138.46 | Class A Common Stock |

| 2026-01-26 | Cannon-Brookes Michael (CEO, Co-Founder) | Sell | 50.00 | 133.03 | Class A Common Stock |

| 2026-01-26 | Farquhar Scott () | Sell | 50.00 | 133.03 | Class A Common Stock |

| 2026-01-26 | Farquhar Scott () | Sell | 100.00 | 134.51 | Class A Common Stock |

| 2026-01-26 | Farquhar Scott () | Sell | 1,987.00 | 135.81 | Class A Common Stock |

| 2026-01-26 | Farquhar Scott () | Sell | 2,664.00 | 136.62 | Class A Common Stock |

| 2026-01-26 | Farquhar Scott () | Sell | 950.00 | 137.54 | Class A Common Stock |

| 2026-01-26 | Farquhar Scott () | Sell | 1,914.00 | 138.46 | Class A Common Stock |