Insider Selling Signals and Market Sentiment

On January 27, 2026, Senior EVP & CFO Cullen Susan executed a 480‑share sale of Flushing Financial Corp. common stock at $15.54 per share, just one day after the company reported its fourth‑quarter earnings. The trade coincided with a modest 0.03 % drop in the share price to $15.37, and the broader market reacted with a 3.02 % weekly decline. Social‑media buzz spiked to 381 % while sentiment hovered at neutral, indicating heightened attention but no clear directional bias. The timing suggests that the CFO may be taking a tactical position—perhaps harvesting gains or rebalancing a portfolio—rather than signaling a fundamental shift in confidence.

Implications for Investors and Strategic Outlook

Cullen’s sell, together with a 7,040‑share repurchase earlier that week, shows a net liquidity‑management strategy rather than a wholesale divestiture. Investors can interpret this as the CFO’s personal portfolio management rather than a red flag for the company. Nonetheless, the simultaneous trading activity of other top executives—two sells by SEVP Francis Korzewinski and two by EVP Astrid Burrowes—raises questions about internal capital allocation. If a pattern of short‑term selling emerges, it could hint at liquidity needs or management optimism that the market has yet to fully absorb. The pending OceanFirst merger, highlighted in the earnings release, remains the most significant catalyst that could alter the company’s valuation trajectory in the coming quarters.

Cullen Susan: A Profile of Transactional Discipline

Cullen’s transaction history over the past year is characterized by frequent, small‑volume trades that balance buying and selling within a tight price range. In early January 2026, she purchased 7,040 shares at $0 per share (a “buy” reported without a price, likely a cost‑basis adjustment) and sold 687 shares at $16.10, bringing her post‑transaction holding to 79,799 shares. The most recent sale of 480 shares at $15.54 reduced her position to 86,359 shares. Her holdings remain concentrated in common stock, with a modest 19,765 shares held in a 401(k) plan. Historically, her trades are spread across the calendar, with no single transaction exceeding 10 % of her total shares, indicating a prudent, incremental approach rather than aggressive liquidation.

What This Means for the Future

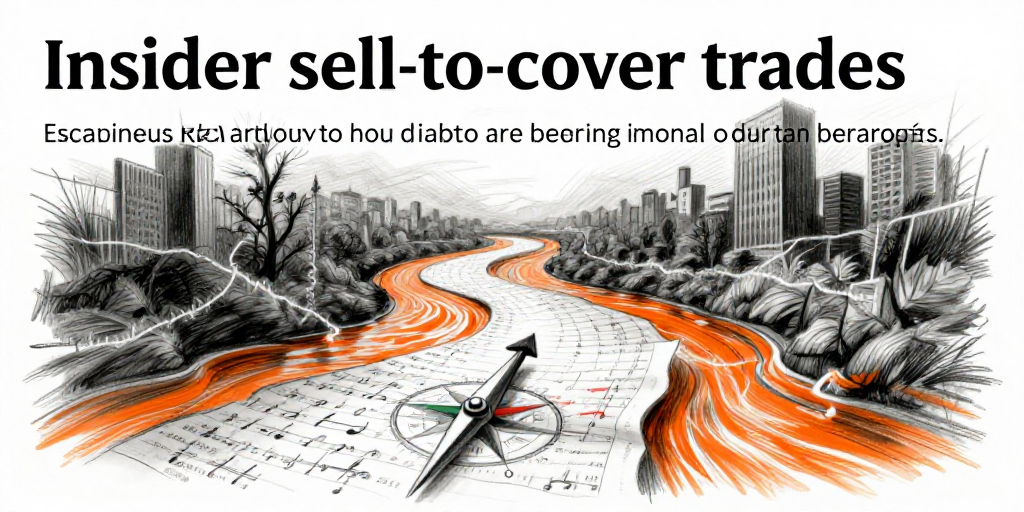

For investors, Cullen’s recent activity signals routine portfolio management rather than a warning. However, the collective selling by senior management could be an early warning sign of potential liquidity pressures, especially if the OceanFirst merger stalls. The company’s solid earnings profile, low non‑performing assets, and steady deposit growth provide a buffer, but market participants should monitor subsequent insider filings for any escalation in selling volume. A sustained trend of high‑frequency, low‑value sales could presage a shift in confidence and prompt a reassessment of Flushing Financial’s valuation relative to its peers.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-01-27 | Cullen Susan (Sr. EVP & CFO) | Sell | 480.00 | 15.54 | Common Stock |

| N/A | Cullen Susan (Sr. EVP & CFO) | Holding | 19,765.00 | N/A | Common Stock |

| 2026-01-27 | KORZEKWINSKI FRANCIS W (SEVP) | Sell | 480.00 | 15.54 | Common Stock |

| N/A | KORZEKWINSKI FRANCIS W (SEVP) | Holding | 108,278.00 | N/A | Common Stock |

| 2026-01-27 | Burrowes Astrid (EVP) | Sell | 229.00 | 15.54 | Common Stock |

| N/A | Burrowes Astrid (EVP) | Holding | 32,155.00 | N/A | Common Stock |