Insider Selling at First Commonwealth: What It Means for Investors

First Commonwealth Financial Corp. (FCB) saw a flurry of insider activity on February 5, 2026, when EVP/Chief Financial Officer Reske James R sold a total of 1,810 shares of common stock across eight separate transactions. The sales were executed at prices ranging from $18.77 to $19.00, effectively capturing the near‑peak market price that closed at $18.88 on the previous trading day. While a single block of 1,810 shares is modest relative to the company’s $1.94 billion market cap, the timing and concentration of the sales—amid a broader wave of C‑level selling—raises questions for investors about management’s confidence in the firm’s near‑term outlook.

Market‑wide Insider Selling Signals

The same day, several other senior executives—President & CEO Michael Price, EVP of Revenue Jane Grebenc, and EVP of Risk Matthew Tomb—each disposed of sizeable blocks of shares. Collectively, these transactions represent a coordinated exit strategy that could indicate management’s view of a short‑term price ceiling. From a technical standpoint, the sell‑side pressure coincided with a 4.44 % weekly gain and a 10.05 % monthly rise, yet the shares have been trading near the 52‑week high of $19.08. The negative sentiment score of –41 and a buzz spike of nearly 285 % on social media suggest that the market is already reacting to the insider moves, amplifying volatility in the coming days.

Implications for Investors and the Company’s Outlook

For shareholders, the insider sales are a mixed signal. On one hand, senior executives are taking profits, which could be interpreted as a healthy confidence in the company’s fundamentals—particularly given the strong earnings trend and a price‑earnings ratio of 12.9, comfortably below the sector average. On the other hand, coordinated selling at a market high may precede a pullback, especially if the bank’s loan portfolio or capital ratios face headwinds. The company’s recent quarterly results are not yet available, and the absence of new earnings guidance means investors must rely on insider behavior and macro‑financial metrics to gauge future performance.

A Profile of Reske James R: The Cautious CFO

Reske James R has a long history of measured trading activity. Over the past year, he has executed numerous small‑to‑mid‑size sell orders, often clustering them around key price levels. For example, in late January 2026 he sold 21,000 shares and then 9,167 shares on the same filing, reducing his holdings from 101,311 to 92,144 shares. He also bought 21,000 shares earlier that month, indicating a willingness to add positions when the price dips below the 52‑week low of $13.54. His pattern shows a preference for incremental selling rather than large block trades, suggesting a strategy aimed at minimizing market impact.

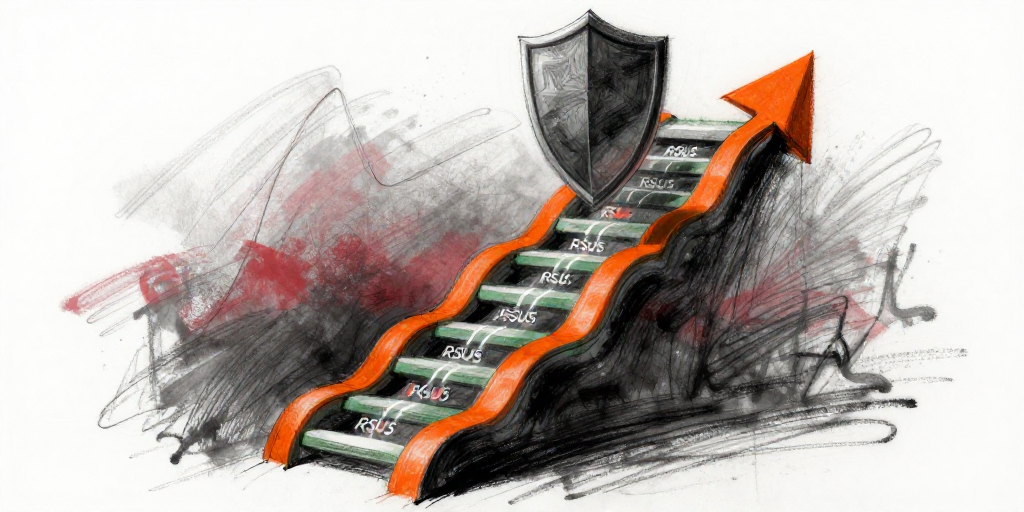

In addition to trading, Reske holds 8,000 restricted stock units (RSUs) granted in 2024 and 15,300 RSUs granted in 2025, both vesting over three years. The RSU balance provides a long‑term incentive, aligning his interests with those of shareholders. The blend of active trading and RSU holdings paints a picture of a CFO who balances short‑term liquidity needs with a commitment to the company’s future.

What to Watch Going Forward

- Liquidity Position – Monitor FCB’s balance sheet for changes in cash and short‑term assets that could prompt further insider selling.

- Credit Portfolio – As a bank holding, loan quality and credit losses will be critical; any deterioration could fuel further profit‑taking by management.

- Capital Adequacy – Keep an eye on the bank’s capital ratios; a decline may necessitate additional share sales or capital injections.

- Earnings Guidance – The next earnings release will be a key data point; any upside surprise could dampen the sell‑side pressure observed today.

In summary, Reske James R’s recent sell‑offs, set against a backdrop of broader C‑level selling, suggest a short‑term profit‑taking stance rather than a fundamental deterioration. Investors should interpret these moves as a signal to monitor upcoming earnings and balance‑sheet developments, rather than an immediate red flag.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-02-05 | Reske James R (EVP/Chief Financial Officer) | Sell | 180.00 | 18.77 | Common Stock |

| 2026-02-05 | Reske James R (EVP/Chief Financial Officer) | Sell | 260.00 | 18.90 | Common Stock |

| 2026-02-05 | Reske James R (EVP/Chief Financial Officer) | Sell | 100.00 | 18.92 | Common Stock |

| 2026-02-05 | Reske James R (EVP/Chief Financial Officer) | Sell | 932.00 | 18.93 | Common Stock |

| 2026-02-05 | Reske James R (EVP/Chief Financial Officer) | Sell | 100.00 | 18.94 | Common Stock |

| 2026-02-05 | Reske James R (EVP/Chief Financial Officer) | Sell | 300.00 | 18.95 | Common Stock |

| 2026-02-05 | Reske James R (EVP/Chief Financial Officer) | Sell | 100.00 | 18.96 | Common Stock |

| 2026-02-05 | Reske James R (EVP/Chief Financial Officer) | Sell | 100.00 | 19.00 | Common Stock |

| N/A | Reske James R (EVP/Chief Financial Officer) | Holding | 8,000.00 | N/A | Restricted Stock Units-Service Based |

| N/A | Reske James R (EVP/Chief Financial Officer) | Holding | 15,300.00 | N/A | Restricted Stock Units-Service Based |

| 2026-02-05 | Grebenc Jane (EVP/Chief Revenue Officer) | Sell | 5,000.00 | 18.70 | Common Stock |

| 2026-02-05 | Grebenc Jane (EVP/Chief Revenue Officer) | Sell | 2,402.00 | 18.90 | Common Stock |

| N/A | Grebenc Jane (EVP/Chief Revenue Officer) | Holding | 8,750.00 | N/A | Restricted Stock Units-Service Based |

| N/A | Grebenc Jane (EVP/Chief Revenue Officer) | Holding | 16,750.00 | N/A | Restricted Stock Units-Service Based |

| 2026-01-27 | Montgomery Norman J (EVP/Business Integration) | Sell | 10,070.00 | N/A | Common Stock |

| 2026-01-27 | Riggle Carrie L (EVP/Human Resources) | Sell | 4,309.00 | N/A | Common Stock |

| 2026-01-27 | Tomb Matthew C (EVP/Chief Risk Officer) | Sell | 7,922.00 | N/A | Common Stock |

| 2026-01-27 | Price T Michael (President & CEO) | Sell | 19,363.00 | N/A | Common Stock |

| 2026-01-27 | Reske James R (EVP/Chief Financial Officer) | Sell | 11,675.00 | N/A | Common Stock |

| 2026-01-27 | Grebenc Jane (EVP/Chief Revenue Officer) | Sell | 13,036.00 | N/A | Common Stock |