Insider Selling Continues to Mount at LYONDELLBASELL ADVANCED

The latest Form 4 filing on January 26, 2026 shows Chief Technology Officer Jeffrey Pinner selling 200 shares of Class A common stock at an average price of $105.29, followed by additional sales of 4,064 and 1,600 shares at $107.36 and $108.07, respectively. These transactions, executed under a Rule 10b5‑1 trading plan, bring Pinner’s holdings down to just 9,133 shares. When viewed against the backdrop of a 10‑day sell‑spree that has seen Pinner liquidate roughly 25 % of his stake, the move signals a cautious stance amid a market that has slipped more than 10 % in the last month.

What This Means for Investors

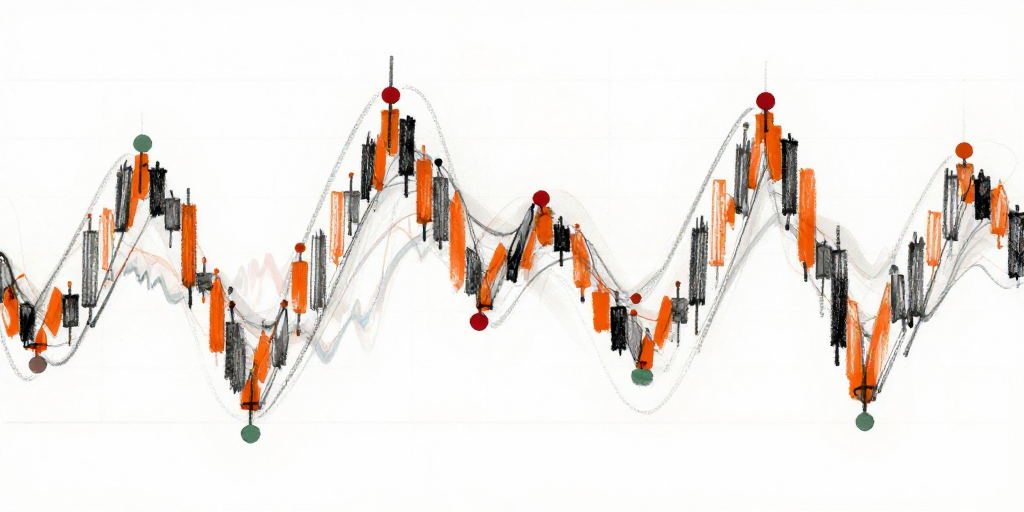

From an investor’s perspective, Pinner’s disciplined use of a pre‑planned selling schedule suggests he is managing risk rather than reacting to market noise. However, the timing—just as the company’s stock sits near a 52‑week low of $29.66 and a steep 52‑week high of $153.86—may reinforce concerns that insiders are unloading shares ahead of the upcoming earnings call on February 10. With a price‑to‑earnings ratio of 45.22 and a year‑to‑date rally of +95 %, the market has been volatile. If the earnings report falls short of expectations, the recent sell‑pressure could accelerate a price correction, tightening the already narrow upside potential.

Pinner Jeffrey Tsvi: A Profile of Strategic Exit Moves

Pinner’s transaction history over the past nine months paints a picture of a CTO who prefers systematic, rule‑based sales. His largest single sell on December 5, 2025, involved 2,808 shares at $131.72, followed by a series of mid‑range trades between $124 and $135 in late November and early December. In October, he sold 3,110 shares at $146.73 and 1,973 shares at $147.52, reflecting a steady divestment at mid‑to‑high valuation levels. The pattern indicates a gradual reduction of exposure rather than a sharp liquidation, suggesting confidence in the company’s long‑term trajectory while mitigating concentration risk.

Company‑Wide Insider Activity: A Mixed Picture

While Pinner’s sales are notable, other insiders, including CEO Vladimir Tenev, have been active on the buying side, purchasing 375,000 shares on January 5, 2026. Tenev’s simultaneous sell‑activities—spanning 375,000 to 49,521 shares across the week—highlight a complex insider strategy that balances ownership and liquidity needs. Legal and brokerage officers have also been selling sizable blocks, underscoring a broader trend of insiders taking profit positions as the stock approaches its 52‑week high.

Outlook

With the earnings announcement on February 10, investors will be looking for clarity on revenue growth and profitability. Pinner’s continued use of a 10b5‑1 plan signals a measured approach to portfolio management, but the cumulative sell pressure may amplify market volatility if earnings disappoint. For those holding LYONDELLBASELL ADVANCED, the key will be to monitor both insider activity and the company’s financial guidance—particularly as the firm operates in the highly competitive fintech space and aims to maintain its $94‑billion market cap amid regulatory and technological shifts.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-01-26 | Pinner Jeffrey Tsvi (Chief Technology Officer) | Sell | 200.00 | 105.29 | Class A Common Stock |

| 2026-01-26 | Pinner Jeffrey Tsvi (Chief Technology Officer) | Sell | 4,064.00 | 107.36 | Class A Common Stock |

| 2026-01-26 | Pinner Jeffrey Tsvi (Chief Technology Officer) | Sell | 1,600.00 | 108.07 | Class A Common Stock |