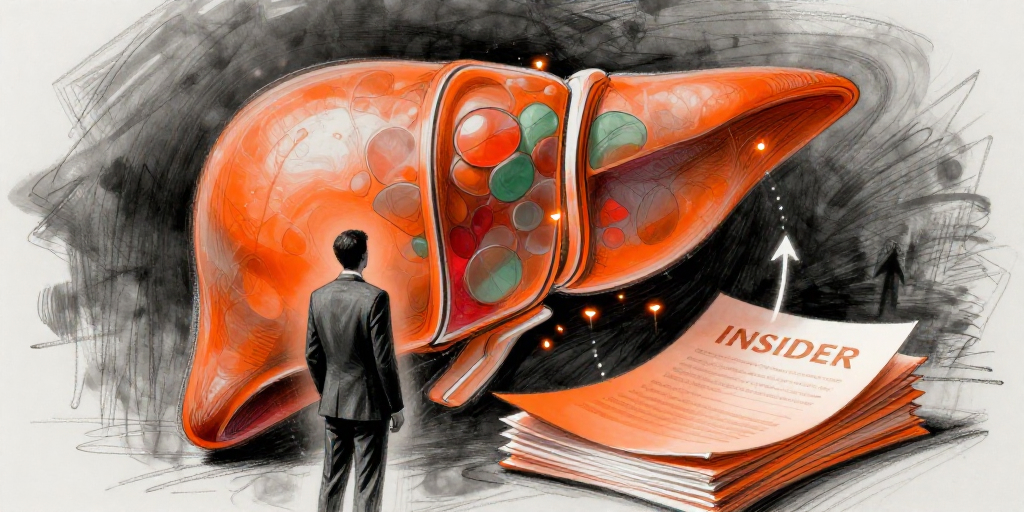

Insider Buying Fuels Optimism Amid a Bullish Market Cycle

Elanco Animal Health’s latest 4‑filed transaction shows President, CEO and Director Jeffrey Simmons purchasing 113.49 Deferred Stock Units (DSUs) on 23 January 2026 at a price of $24.40 per unit. The deal brings his post‑transaction holdings to roughly 18,959 DSUs, an increase of about 0.2 % over his previous stake. While the unit price matches the current market price ($24.62), the timing is noteworthy. The share price has recently risen 1.9 % in the last week and is trading near the 52‑week high, suggesting that the company’s valuation has recovered strongly from its 2025 trough. Simmons’ incremental buy signals confidence in Elanco’s mid‑term prospects, especially as the firm is still riding the momentum of its 2026‑year earnings growth and its expanded companion animal portfolio.

What Does This Mean for Investors?

Signal of Management Belief – Executives typically trade in alignment with their view of the company’s future. Simmons’ regular purchase pattern (over 20 DSU buys since July 2025) shows sustained bullishness. The recent buy is in line with a broader trend of insider buying across the board, including a single buy by the CFO and a buy by the EVP of U.S. Pet Health, indicating executive confidence in the company’s strategic initiatives.

Liquidity and Lock‑up Dynamics – DSUs are a deferred vehicle; they convert to shares upon a triggering event (termination of employment or a specified date). Thus, the actual dilution risk remains limited in the short term, but the incremental investment still reflects a willingness to forego immediate liquidity for long‑term upside.

Valuation Context – At a P/E of 348.16, Elanco trades at a premium relative to earnings, but its price-to-book ratio of 1.8 and recent upward price momentum suggest investors are valuing the company’s future growth potential more than its current earnings. Insider buying can be interpreted as a balancing act: management is comfortable with the current valuation and believes further upside is attainable.

Jeffrey Simmons: A Profile of Consistent Commitment

Jeff Simmons has been the face of Elanco for the past decade, serving as President, CEO and Director since 2015. His transaction history reflects a disciplined, gradual accumulation strategy:

Frequency – Since July 2025, Simmons has executed 17 DSU purchases, averaging roughly one trade per month. The most recent transaction on 23 January 2026 is the 18th trade, underscoring his steady approach rather than opportunistic spikes.

Scale – Trade sizes vary from 114 DSUs (e.g., 23 January 2026) to 200 DSUs (e.g., 13 June 2025). The average purchase size hovers around 150 DSUs, indicating a methodical accumulation that avoids market impact.

Pricing – The price paid per DSU has trended upwards modestly from $14.90 in July 2025 to $24.40 in January 2026. This reflects a willingness to pay a premium as the stock price recovers from its 2025 low ($8.02). The incremental premium also aligns with the company’s improving fundamentals.

Post‑Transaction Holdings – Simmons’ DSU holdings rose from 17,220 (July 2025) to 18,959 (January 2026), a 10 % increase. Combined with his sizeable common stock holding (over 1.8 million shares), Simmons remains a significant long‑term shareholder.

Strategic Outlook for Elanco

Elanco’s product pipeline in companion animal health continues to expand, driven by both organic growth and strategic acquisitions. The company’s recent focus on digital transformation in pet health—highlighted by the executive title of Modi Rajeev A.—suggests a shift toward data‑driven solutions. This, coupled with the current share price near its 52‑week high, positions Elanco well for capitalizing on a robust pet‑care market.

Bottom Line for Investors

Simmons’ consistent buying, combined with supportive moves from other senior executives, indicates strong insider confidence amid a recovering market. While the company’s valuation remains lofty, the steady accumulation pattern suggests that management believes the current price reflects a fair entry point for long‑term gains. Investors may view the transaction as a positive signal, but should remain mindful of the high P/E and the potential for volatility as the company navigates future growth initiatives.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-01-23 | Simmons Jeffrey N (PRESIDENT, CEO AND DIRECTOR) | Buy | 113.49 | 24.40 | Deferred Stock Units |

| 2026-01-23 | Modi Rajeev A. (SEE REMARKS) | Buy | 57.98 | 24.40 | Deferred Stock Units |

| 2026-01-23 | VanHimbergen Robert M (EVP and CFO) | Buy | 7.80 | 24.40 | Deferred Stock Units |