Insider Activity at Greif Inc. – What the Recent Trades Signal

Greif Inc. has been a quiet performer on the NYSE, trading steadily around its $75‑per‑share range and sitting near a 52‑week high that it has not yet surpassed. Yet the latest insider filing on February 3 shows a flurry of moves by EVP and CFO Lawrence Hilsheimer that may offer a window into the company’s near‑term strategy.

A Mixed Bag of Trades in a Single Day

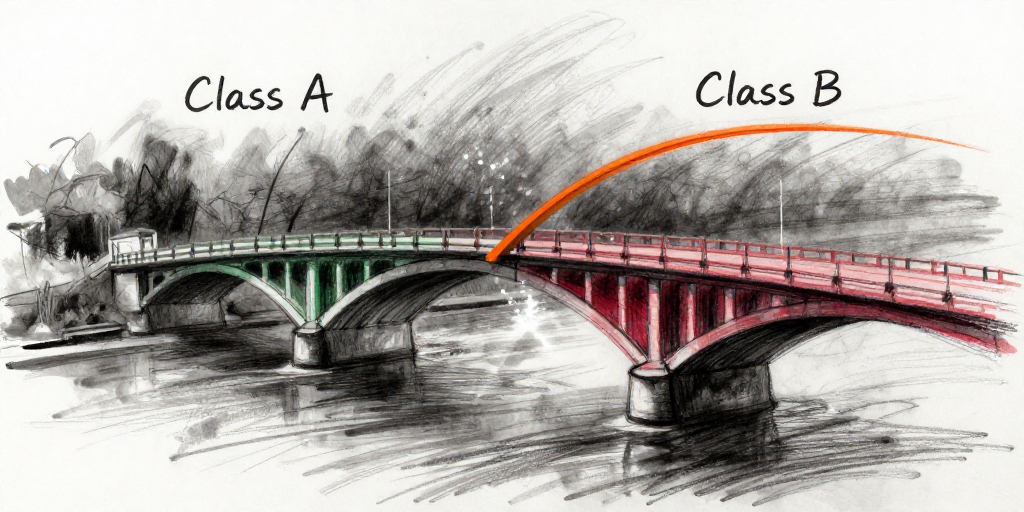

On the filing date Hilsheimer sold 14,465 shares of Class A stock for $71.93 and another 8,313 shares for $71.65, a total of roughly $2.2 million in cash. These sales were balanced by purchases of 5,000 and 6,617 shares of Class B stock at $88.18 and $86.84 respectively, totaling about $1.1 million. The net effect was a modest cash outflow, but the move also reduced his Class A holdings from 67,505 to 0 shares (as the stock was held in a Charitable Remainder Annuity Trust), while bolstering his Class B stake to 207,186 shares.

This pattern—selling the more liquid Class A shares while buying the less liquid, potentially higher‑value Class B shares—suggests a strategic shift rather than a panic sale. It could reflect confidence that Class B’s premium valuation will be rewarded over the longer term, or a desire to diversify exposure within Greif’s dual‑class structure.

How Does This Fit the Broader Insider Picture?

Hilsheimer’s recent history shows a mix of large buys and sells, often in Class A shares. In December 2025 he sold several hundred shares repeatedly, and in January 2026 he made sizeable purchases that increased his holdings to the high‑90,000‑share level. The current February trades mark the first time he has cleared his Class A position, possibly indicating a reallocation of capital to Class B or to other securities. Other senior executives have been active too: the CEO and several VPs have taken both buying and selling positions, but none as pronounced as Hilsheimer’s move in the current window.

What Might Investors Take Away?

Signal of Confidence in Class B – The purchase of Class B shares amid a sell‑off of Class A may be read as a bet that the higher‑priced class will outperform. Investors who hold Class A could view this as a cue to assess the merits of converting or accumulating Class B shares.

Capital Management Play – The net cash outflow is modest relative to the size of his holdings, suggesting that Hilsheimer is not divesting to fund a major project or cover a liquidity need. Instead, it appears to be a deliberate portfolio rebalancing that aligns with his long‑term view of Greif’s growth prospects.

Potential Tax or Estate Considerations – The fact that the sold shares were held in a Charitable Remainder Annuity Trust hints at a philanthropic motive. Investors should note that the trust’s payout schedule could affect future cash flows and the overall ownership structure.

Market Sentiment – With a near‑zero sentiment score and a moderate buzz level, the transaction has not yet triggered significant social‑media backlash or bullish hype. The stock’s price is already near its 52‑week high, so a brief dip is unlikely unless further large sales occur.

Hilsheimer Lawrence A.: A Profile Based on Historical Patterns

Position & Influence – As EVP and CFO, Hilsheimer sits at the nexus of Greif’s financial strategy and operational oversight. His trades carry weight because they reflect the views of a senior executive who is intimately aware of the company’s cash flows and capital allocation decisions.

Trading Style – Historical filings show a tendency to buy large blocks of Class A stock (e.g., 36,921 shares in January 2026) and later sell them in smaller increments. The recent shift to Class B indicates a willingness to adjust the ownership mix in response to perceived valuation differences.

Risk Appetite – The consistent pattern of buying and holding a substantial minority stake, coupled with occasional sales for liquidity or rebalancing, suggests a balanced approach. Hilsheimer is neither a frequent trader nor a passive holder; instead, he appears to time his actions around key corporate events or market cycles.

Implications for Corporate Governance – By actively managing his holdings, Hilsheimer demonstrates a commitment to aligning personal interests with shareholder value. This can enhance investor confidence in the board’s stewardship, especially in a dual‑class environment where voting power and market value diverge.

Looking Forward

Greif’s stock remains firmly entrenched near its 52‑week high, and the company’s fundamentals—solid earnings, modest P/E, and steady commodity‑driven demand—support a bullish outlook. Hilsheimer’s latest insider activity signals a nuanced view of the company’s dual‑class structure but does not portend any immediate distress. Investors should monitor subsequent filings for further shifts in Class B holdings and watch for any commentary on Greif’s strategic priorities that may explain the CFO’s rebalancing decision.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-02-03 | Hilsheimer Lawrence A. (EVP and CFO) | Sell | 14,465.00 | 71.93 | Class A Common Stock |

| 2026-02-03 | Hilsheimer Lawrence A. (EVP and CFO) | Buy | 5,000.00 | 88.18 | Class B Common Stock |

| 2026-02-03 | Hilsheimer Lawrence A. (EVP and CFO) | Sell | 8,313.00 | 71.65 | Class A Common Stock |

| 2026-02-03 | Hilsheimer Lawrence A. (EVP and CFO) | Buy | 6,617.00 | 86.84 | Class B Common Stock |

| 2026-02-04 | Hilsheimer Lawrence A. (EVP and CFO) | Buy | 6,475.00 | 91.20 | Class B Common Stock |

| 2026-02-04 | Hilsheimer Lawrence A. (EVP and CFO) | Buy | 230.00 | 90.57 | Class B Common Stock |

| N/A | Hilsheimer Lawrence A. (EVP and CFO) | Holding | 1,236.39 | N/A | Class A Common Stock |