Insider Activity Signals Confidence, but Raises Questions Greif Inc.’s recent director‑dealing filing shows senior executive Alexander Johansson, SVP SBU/GM Steel Solutions, maintaining a substantial 150‑share Class A holding in the company. The transaction, filed on December 9, 2025, coincided with a flat stock price of $72.49 and a modest negative sentiment score of –19. Despite the lack of a price change, the move illustrates that key executives are willing to keep a visible stake in the business, suggesting they believe the company’s long‑term prospects remain attractive.

Patterns of Buying and Selling Among Top Management When looking beyond Johansson, the broader insider activity on January 14, 2026 reveals a mix of buys and sells across several senior officers. Executives such as Hoffman, Taylor, Bouet, and Rosgaard executed multiple transactions that day, with net buying in some cases and net selling in others. Notably, CFO Hilsheimer and President Rosgaard both made large purchases (over 18,000 shares each) but also sold sizeable blocks later that day, reflecting a balancing act between capital allocation and liquidity needs. The simultaneous buying and selling may indicate routine portfolio rebalancing rather than a signal of impending corporate moves.

What Does This Mean for Investors? For shareholders, the pattern of insider activity is a double‑edged sword. On one hand, continued ownership by top managers can be interpreted as a vote of confidence in the company’s strategy, especially given Greif’s solid 52‑week high and 17% annual return. On the other hand, the frequent selling of shares—often in large blocks—raises concerns about liquidity and potential pressure on the stock price if the market interprets these sales as a lack of conviction. Investors should monitor whether these transactions align with corporate milestones or simply reflect personal portfolio management.

Impact on Greif’s Future Trajectory Greif’s core business in industrial packaging is positioned in a resilient materials sector, and its valuation multiples suggest moderate growth expectations. The insider transactions do not appear to signal a strategic shift, but the combination of high buy‑sell volume and a relatively high price‑to‑earnings ratio of 18.62 means that any significant insider sell‑off could test the market’s appetite for the stock. Should insiders begin to divest more aggressively, analysts may need to reassess the company’s valuation and growth outlook. Conversely, sustained buying by senior management could reinforce confidence in Greif’s ability to capitalize on its diversified product portfolio and global service network.

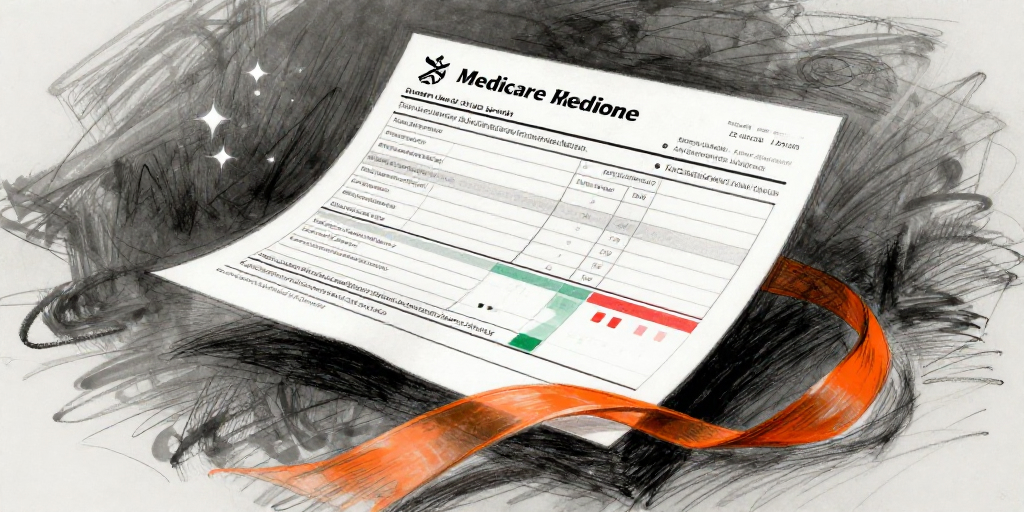

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| N/A | Johansson Alexander (SVP SBU/GM Steel Solutions) | Holding | 150.00 | N/A | Class A Common Stock |

| N/A | Johansson Alexander (SVP SBU/GM Steel Solutions) | Holding | 0.00 | N/A | Class B Common Stock |

| N/A | Johansson Alexander (SVP SBU/GM Steel Solutions) | Holding | N/A | N/A | Restricted Stock Unit |