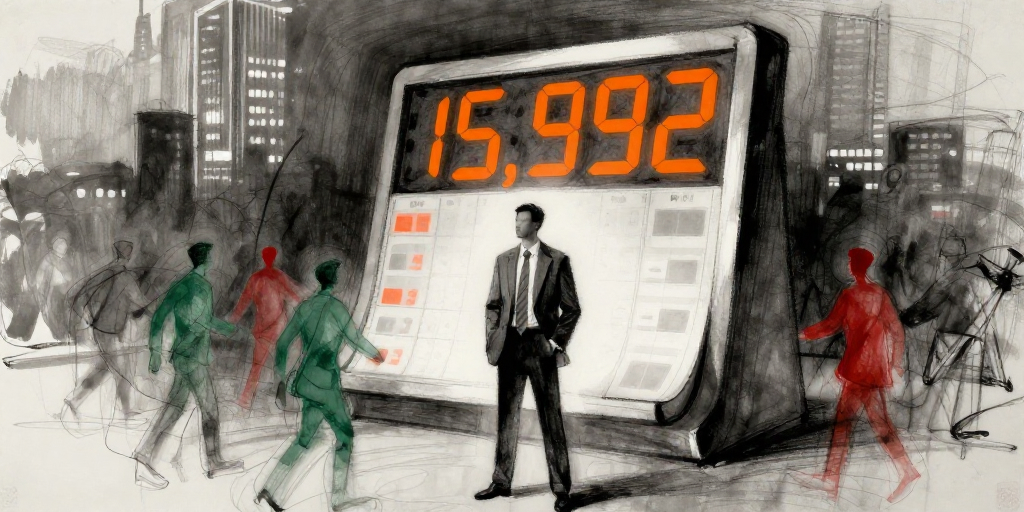

Insider Buying Continues Amid Volatile Share Price

Despite a steep decline in its share price over the past month, Immuneering Corp. (IMRX) has seen continued insider buying by its senior leadership. On January 13, 2026, Chief People Officer Leah R. Neufeld purchased 2,626 Class A shares at $4.15 each, bringing her total holdings to 25,970 shares. The transaction was priced almost exactly at the market close of $4.43, indicating that Neufeld was not taking advantage of a significant discount but rather buying on a day when the stock was already trading near its recent lows. In the context of a 26.48 % monthly slide and a 10.78 % weekly drop, the purchase may signal confidence in the company’s long‑term strategy rather than a speculative play.

What the Buying Means for Investors

Insider purchases are often viewed as a positive signal, suggesting that those who know the company’s future best interests feel optimistic. Neufeld’s trade follows a pattern of steady buying: she acquired 11,815 shares at $1.43 on September 15, 2025, and 800 shares at $6.38 on October 1, 2025, each time buying at or below the prevailing market price. These transactions coincide with periods of market volatility, indicating a willingness to invest during downturns. For investors, this could be interpreted as a “buy the dip” strategy that aligns the executives’ interests with shareholders. However, the company’s negative P/E ratio and the lack of recent press releases beyond early January may temper enthusiasm, as the stock remains highly speculative.

Neufeld’s Insider Profile

Leah R. Neufeld, as Chief People Officer, has demonstrated a consistent buying pattern that suggests a long‑term commitment. Her transactions have been concentrated in Class A common stock, the primary equity vehicle for Immuneering, and she has never sold any shares during the reporting period. Her most recent purchase was made at a price that is roughly 6 % below the 52‑week low, a strategy that could be aimed at building a larger stake during periods of low market sentiment. Compared to other insiders, Neufeld’s activity is modest in volume but high in frequency, reflecting a disciplined approach to accumulation. Her purchases coincide with key milestones, such as the Phase 2a pancreatic cancer trial announcement, hinting that she may view clinical progress as a driver of future value.

Company‑Wide Insider Activity in Context

While Neufeld’s buy is noteworthy, it is part of a broader pattern of insider buying at Immuneering. Peter Feinberg, who holds no official title but appears repeatedly in filings, has been an active buyer, purchasing 20,000 shares on January 12, 2026, and accumulating large positions in October 2025. These moves, along with the purchases of the CEO and other executives, suggest that the leadership team is positioning itself for a potential upside. However, the sheer volume of insider holdings relative to the market cap (approximately $286 million) raises questions about liquidity and potential dilution if further shares are issued.

Bottom Line for the Trading Desk

For the trading desk, Neufeld’s latest purchase confirms that senior management remains engaged, even as the stock’s price volatility increases. It may be prudent to monitor the stock’s short‑term technical signals while keeping an eye on any forthcoming data from the ongoing clinical trials. The insider activity provides a bullish signal in an otherwise bearish market environment, but it should be balanced against the company’s negative earnings trajectory and limited recent disclosures. As always, investors should assess whether the current valuation aligns with the long‑term potential suggested by the leadership’s continued buying.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-01-13 | Neufeld Leah R (CHIEF PEOPLE OFFICER) | Buy | 2,626.00 | 4.15 | Class A Common Stock |