Insider Buying Spikes at Stock Yards Bancorp

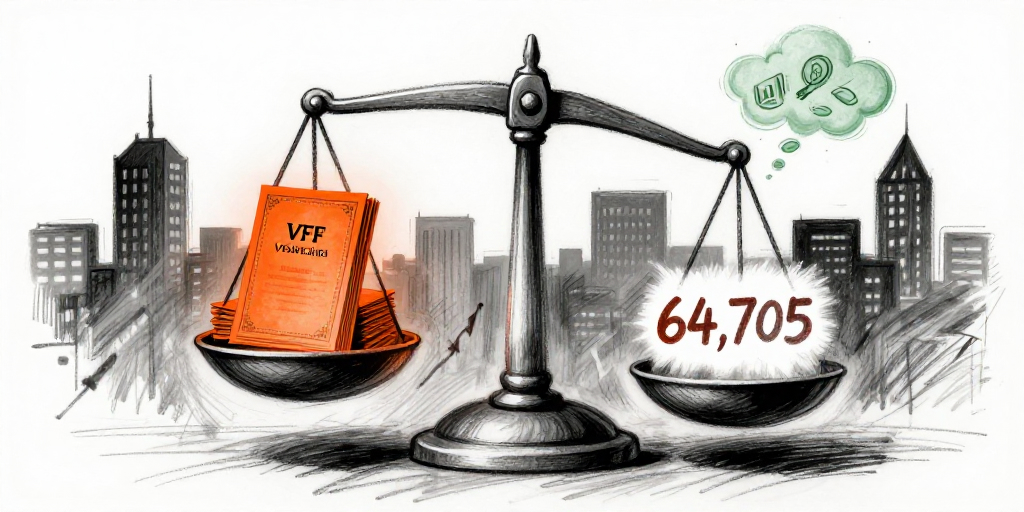

The January 28, 2026 filing shows John Schutte purchasing 131 shares of Stock Yards Bancorp Common Stock at $67.65 each, a price that sits just below the closing level of $67.65 on January 27. While the absolute dollar amount ($8,830) is modest, the move is part of a broader buying pattern that has defined Schutte’s recent insider activity. Over the past year, Schutte has executed at least 11 purchases totaling roughly 1,000 shares, consistently buying at or near the current market price. The timing—just a day after the bank announced its Field & Main acquisition—suggests that insiders are looking to reinforce confidence in the deal and the bank’s growth trajectory.

What the Buying Trend Means for Investors

Consistent insider purchases can be a bullish signal, indicating that those who understand the company’s fundamentals believe the stock is undervalued or that future earnings will improve. In Stock Yards’ case, the acquisition of Field & Main and record fourth‑quarter results point to a strategy of organic growth through targeted acquisitions. Schutte’s incremental buys, coupled with similar activity from other executives (Saunier, Priebe, Hardy, Bickel), reinforce a narrative of collective confidence. For investors, this could translate into a short‑term price lift as the market incorporates these signals, especially given the current weekly decline of 6.15% and a 52‑week low of $60.75.

John Schutte: A Profile of Cautious Optimism

John Schutte’s insider history is characterized by steady, incremental purchases rather than large, sweeping transactions. Since 2025, he has bought shares in a series of small trades—ranging from 63 to 131 shares—at prices that hover near the prevailing market level. His holdings remain modest, at 8,830 shares post‑transaction, compared with the 82,940 shares he held in 2025. Schutte also maintains a long‑standing stock appreciation right (SAR) holding of 1,000 shares, indicating a willingness to benefit from future appreciation without immediate dilution. This pattern suggests a long‑term, patient investment philosophy rather than a speculative play.

Implications for Stock Yards’ Future

The combination of a strategic acquisition, robust earnings, and insider buying points to a company positioned for steady expansion. The bank’s market cap of $2.0 billion and a P/E of 14.76 place it within the upper mid‑range of peer banks, yet its price has been relatively flat over the past year. Should the Field & Main deal close in Q2 2026 and integrate successfully, we might expect a gradual upside to the share price, potentially moving toward the 52‑week high of $83.83. Investors should monitor for further insider activity; continued buying, especially in larger tranches, would strengthen the bullish case, while any significant selling could trigger a reassessment of the bank’s growth prospects.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| N/A | Schutte John () | Holding | 83,768.00 | N/A | Common Stock |

| 2026-01-28 | Schutte John () | Buy | 131.00 | 67.65 | Common Stock |

| 2019-08-28 | Schutte John () | Holding | 1,000.00 | N/A | Stock Appreciation Right |

| N/A | Saunier Edwin S () | Holding | 6,217.00 | N/A | Common Stock |

| 2026-01-28 | Saunier Edwin S () | Buy | 59.00 | 67.65 | Common Stock |

| 2022-07-20 | Saunier Edwin S () | Holding | 1,000.00 | N/A | Stock Appreciation Right |

| 2026-01-28 | Priebe Stephen M () | Buy | 119.00 | 67.65 | Common Stock |

| N/A | Priebe Stephen M () | Holding | 4,971.00 | N/A | Common Stock |

| 2026-01-28 | Hardy David L. () | Buy | 137.00 | 67.65 | Common Stock |

| N/A | Hardy David L. () | Holding | 2,838.00 | N/A | Common Stock |

| 2026-10-21 | Hardy David L. () | Holding | 1,000.00 | N/A | Stock Appreciation Right |

| 2026-01-28 | Bickel Paul J III () | Buy | 119.00 | 67.65 | Common Stock |

| N/A | Bickel Paul J III () | Holding | 9,175.00 | N/A | Common Stock |

| N/A | Bickel Paul J III () | Holding | 11,328.00 | N/A | Common Stock |

| N/A | Bickel Paul J III () | Holding | 580.00 | N/A | Common Stock |

| 2019-01-16 | Bickel Paul J III () | Holding | 1,000.00 | N/A | Stock Appreciation Right |