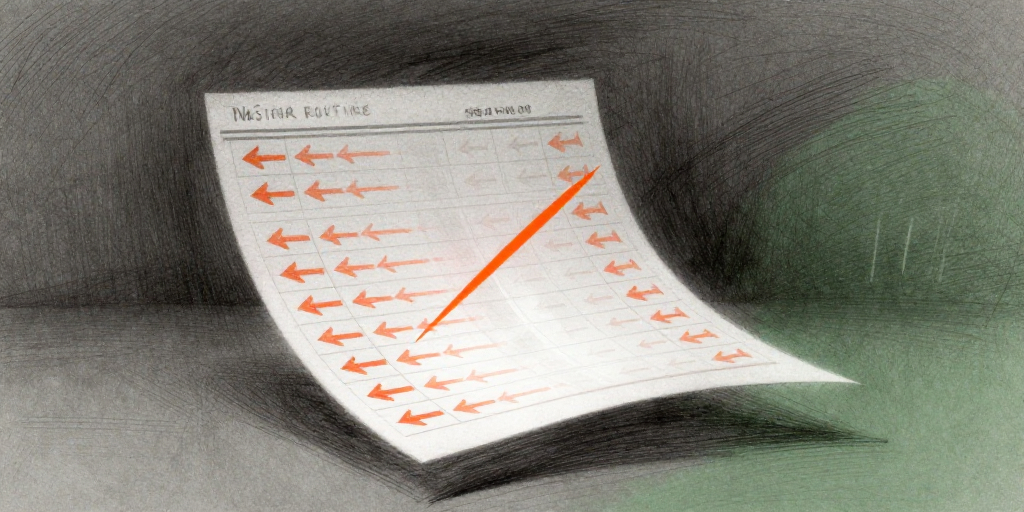

Insider Selling by CFO Larry Goldman Signals a Mix of Cash Management and Market Timing

On January 14 2026, Lightbridge Corp’s Chief Financial Officer, Larry Goldman, executed a Rule 10(b)(5‑1) plan sale of 2,519 shares at a weighted average of $18.00, followed the next day by a second tranche of 6,350 shares at $18.07. The two‑day sell‑off reduces Goldman’s stake to 328,840 shares, a 14 % drop from the 371,000‑plus shares he held after the preceding December transactions. The trades were priced close to the then‑close of $17.57, indicating that the CFO was not selling under distressed pressure but rather following a pre‑established schedule.

What This Means for Investors and the Company’s Future

The timing of these sales coincides with a 6.5 % weekly rally and a 35 % monthly gain, suggesting that Goldman was capitalizing on a short‑term price spike rather than reacting to fundamentals. Lightbridge’s negative earnings and volatile history mean insiders often use structured plans to generate liquidity while maintaining long‑term ownership. For investors, the sell‑off does not signal a loss of confidence; instead, it reflects the CFO’s use of a disciplined trading plan. However, the cumulative insider selling volume in January, together with comparable sales by other executives, could prompt scrutiny from regulators and shareholders concerned about potential insider advantage.

Larry Goldman’s Insider Profile: A Pattern of Structured, Moderate‑Size Trades

Goldman’s trading history since mid‑2025 shows a consistent use of Rule 10(b)(5‑1) plans and a preference for moderate‑sized, staged sales. In December 2025 he sold 8,030 shares at $17.50, 12,500 shares at $17.79, and 5,451 shares at $14.50, reducing his holding from 372,177 to 337,709 shares. Earlier, in June 2025 he executed a series of buys and sells—purchasing 12,861 shares at $10.80, selling 12,861 shares at $16.30, and selling 22,337 shares at $15.61—illustrating a strategy of balancing liquidity needs with market positioning. The CFO also holds 4,469 employee stock options, indicating continued alignment with the company’s long‑term upside. Overall, Goldman’s pattern suggests prudent cash management rather than opportunistic liquidation.

Insider Activity Across Lightbridge’s Leadership

Beyond Goldman, Lightbridge’s CEO Seth Grae and EVP Mushakov have also engaged in structured sales and option holdings in the past months. The cumulative insider sales in January were modest relative to the company’s market cap of $549 million, but the pattern of regular, plan‑based selling could raise questions about liquidity management and corporate governance. Analysts will watch whether Lightbridge’s board will reinforce disclosure around insider plans, particularly as the company approaches upcoming investor conferences.

Bottom Line for Stakeholders

For long‑term investors, Goldman’s recent sales are unlikely to materially shift the company’s capital structure or strategic trajectory. The CFO’s disciplined approach and the continued option holdings signal confidence in Lightbridge’s nuclear fuel technology pipeline. Nonetheless, the recent trading activity highlights the importance of monitoring insider plans for potential signals about cash needs, market sentiment, and governance practices—critical factors for evaluating Lightbridge’s risk profile in a volatile, unprofitable energy‑technology sector.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-01-14 | GOLDMAN LARRY (CFO) | Sell | 2,519.00 | 18.00 | Common Stock |

| 2026-01-15 | GOLDMAN LARRY (CFO) | Sell | 6,350.00 | 18.07 | Common Stock |

| 2026-11-09 | GOLDMAN LARRY (CFO) | Holding | 4,469.00 | N/A | Employee Stock Option (right to buy) |