Insider Selling in a Bull Market: What McKesson’s Latest Deal Tells Investors

In early February, McKesson Corp’s SVP of Finance, Rutledge Napoleon B. JR, completed a Rule 10b5‑1‑planned sale of 328 shares at $955 each, wiping out his entire holding. The transaction, filed on 2026‑02‑06, coincided with a modest 0.01 % uptick in the stock and a nearly 90 % surge in social‑media buzz—an unusual spike in a period when the shares were already enjoying a robust 13.68 % weekly rise. The sale’s timing is noteworthy: it came just days after the company reported a quarterly earnings beat, lifted revenue guidance, and an upward revision of analyst price targets, all of which have driven McKesson’s share price toward a 52‑week high of $971.93.

What the Sale Means for Shareholders

The price at which Mr. Napoleon sold—$955—was comfortably above the market close of $948.68 on February 5 and close to the high of the day, suggesting the deal was executed at a favorable level. However, the complete divestiture of his stake, coupled with his pattern of frequent, sizable sales in the past year, may raise questions about internal sentiment. The 10b5‑1 plan, however, provides a safeguard against accusations of insider trading, indicating a pre‑planned, risk‑neutral strategy rather than a reaction to negative news. For investors, the move could be interpreted as a routine portfolio rebalancing rather than a warning signal, especially given McKesson’s solid fundamentals and upward‑sloping earnings trajectory.

Insider Activity Across the Board

Mr. Napoleon’s recent sales are part of a broader trend of significant insider selling at McKesson. The company’s CEO, Brian Tyler, has off‑loaded more than 47,000 shares in June, and the CFO and several EVP‑level executives have each executed multiple block trades in May. While large insider sales can sometimes precede a downturn, the context here is different: the sales cluster around periods of strong earnings releases and market optimism. The overall market cap of $116 billion and a P/E of 27.57 suggest the stock remains over‑valued by some, yet the company’s recurring revenue streams and strategic software initiatives provide a buffer for sustained growth.

A Profile of Rutledge Napoleon B. JR

Over the past 18 months, Mr. Napoleon has sold more than 4,000 shares in a series of 10b5‑1 transactions, with average sale prices hovering in the $700‑$900 range. He has also purchased restricted stock units (RSUs) in May, indicating a willingness to hold onto equity while managing liquidity needs. His transaction history shows a pattern of rapid entry and exit—often buying and selling within days—consistent with a “portfolio‑rebalancer” profile. Analysts who have followed his moves note that he tends to sell during periods of market strength, suggesting confidence in McKesson’s long‑term prospects rather than a lack of faith.

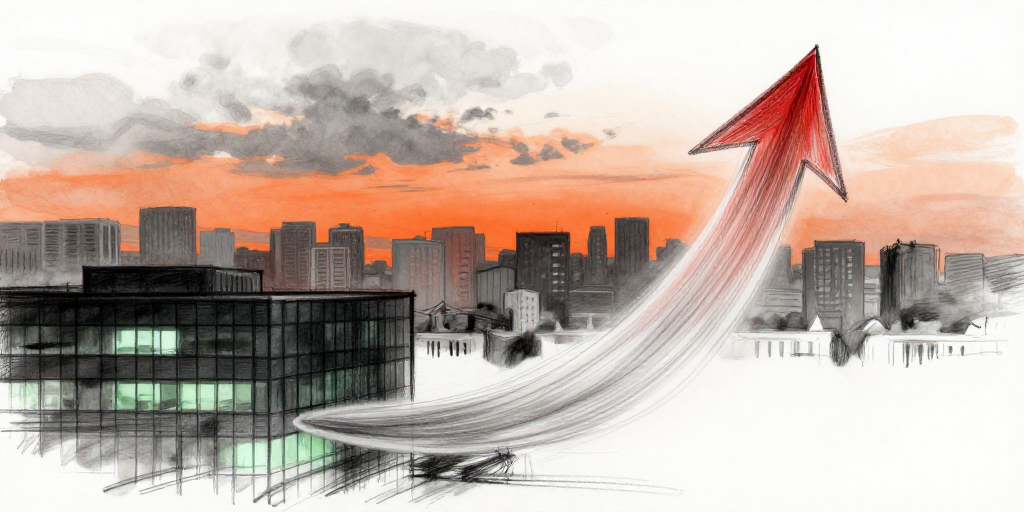

Outlook for McKesson Investors

With the company reporting stronger-than‑expected earnings, a bullish consensus among analysts, and an upward trend in institutional buying, McKesson’s stock appears poised for continued upside. The recent insider sale, when viewed through the lens of a Rule 10b5‑1 plan and a broader context of healthy financials, does not materially alter this outlook. Investors should, however, remain alert to the timing of insider trades, as they can sometimes foreshadow changes in management sentiment or upcoming corporate actions. In the meantime, McKesson’s focus on distribution, integrated software solutions, and patient‑centric services positions it well to capitalize on the evolving healthcare landscape, potentially delivering value to shareholders for years to come.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-02-06 | Rutledge Napoleon B JR (SVP, Controller & CAO) | Sell | 328.00 | 955.00 | Common Stock |