Insider Confidence: Paulson & Co. Buys 18 Million Shares in Tower Hill

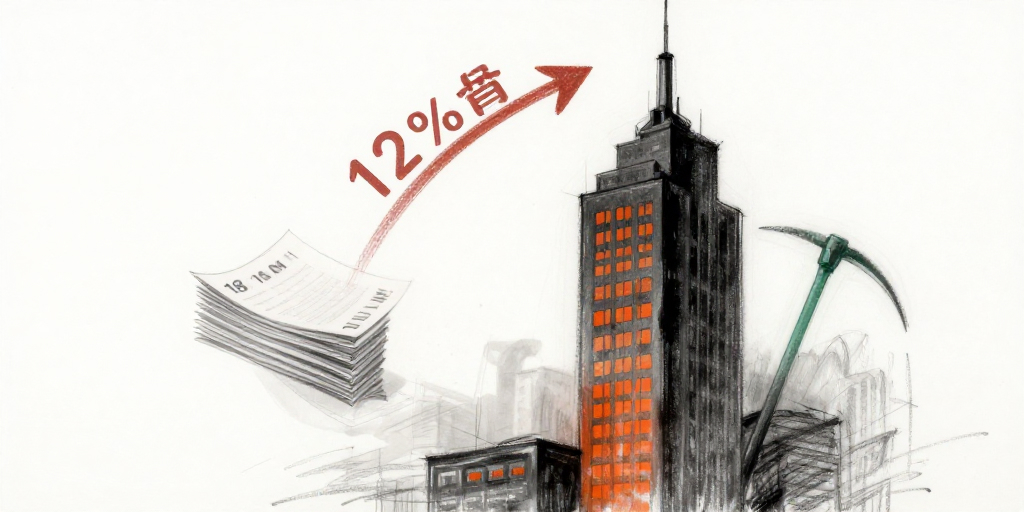

On January 27, 2026, investment‑management giant Paulson & Co. Inc. reported a sizeable purchase of 18,018,018 common shares in International Tower Hill Mines Ltd. The transaction was executed at an average price of $2.22 per share, bringing the Fund’s holdings to 88,257,406 shares—about 12 % of the company’s outstanding equity. The purchase occurred just days after the firm announced a US$65 million public share offering and a US$40 million private placement, a move that has already lifted the stock 17.5 % in the last week and 52.3 % in the month.

What the Trade Says About Insider Sentiment

Paulson’s buy is not an isolated event. The firm’s history of acquisitions of Tower Hill stock, coupled with the current 0.16 % uptick in price on the day of the trade, signals a positive outlook from a sophisticated, long‑term investor. Social‑media buzz surrounding the transaction spiked by 388 % and sentiment hovered at +39, suggesting that both retail and professional audiences are viewing the purchase favorably. The fact that the trade was made at a price well below the 52‑week high of $4.37 indicates that Paulson may see value in the company’s exploration pipeline, particularly its Alaskan and Nevada gold projects, even as the broader metal‑sector remains volatile.

Implications for Investors and the Company’s Future

For shareholders, Paulson’s commitment provides a form of “anchor” support during a period of high volatility. Institutional backing often translates into tighter bid–ask spreads and a more stable share price, which can be especially valuable for a company with a negative earnings figure and a steep P/E of –117.9. The buy may also signal that Tower Hill’s management is confident that the forthcoming financing will translate into tangible asset development and eventual cash flow generation. However, investors should remain cognizant of the company’s high leverage from recent capital raises and the inherent risks of mineral exploration, including the possibility of project delays or cost overruns.

Looking Ahead

With the market cap hovering around CAD 719 million and the stock trading near a 52‑week low of $0.65, there is ample room for upside if the company can deliver on its exploration milestones. Paulson’s stake could serve as a catalyst for other institutional investors to follow suit, potentially leading to a broader market rally. Meanwhile, the company’s management must focus on converting its exploration assets into production and ensuring that the new capital is deployed efficiently to restore profitability and improve the company’s valuation metrics. For investors, the key will be to monitor how quickly Tower Hill can turn its resource potential into revenue—an achievement that could validate Paulson’s bullish stance and unlock further upside for all shareholders.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-01-27 | PAULSON & CO. INC. () | Buy | 18,018,018.00 | 2.22 | Common Shares, no par value |