Insider Buying Signals: Executive Chairman Buys Restricted Shares

On February 3, 2026 the board of Regency Centers Corp. witnessed a notable insider transaction from Executive Chairman Stein Martin E Jr. He purchased a restricted stock grant of 2,069 shares—equivalent to the entire vesting allocation for the year—at no cash cost. The transaction reflects confidence in the company’s long‑term value, as the shares are expected to vest 25% annually beginning February 2027. While the purchase price is zero, the move signals that the Chairman believes the market is undervaluing Regency’s future cash‑generating real estate portfolio.

Broader Insider Activity Highlights Confidence

That same day, President and CEO Lisa Palmer also bought a larger restricted grant of 17,934 shares. With both top executives increasing their long‑term positions, the company’s insider activity suggests a concerted belief in the REIT’s growth prospects. The combined 20,003 shares represent a significant ownership stake and underscore an alignment between management and shareholders—a positive governance cue for investors.

Implications for Investors

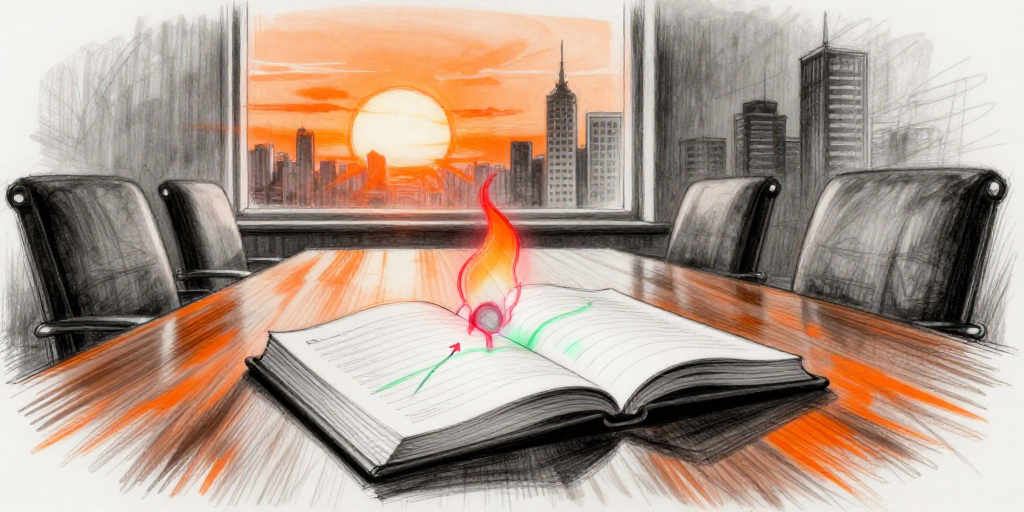

The timing of these purchases coincides with a modest 0.01% increase in share price and a 4.75% weekly rally, indicating that the market is already reacting favorably to Regency’s fundamentals. The recent spike in social‑media buzz (223 % communication intensity) and a positive sentiment score (+14) further amplify investor attention. For long‑term holders, the insiders’ commitment may reduce perceived agency costs and provide a hedge against short‑term volatility. However, the restricted nature of the shares means they cannot be sold until the vesting schedule is met, limiting any immediate dilution concerns.

Looking Ahead

Regency Centers continues to thrive in suburban retail markets, with a portfolio of high‑traffic grocery‑anchored properties. The REIT’s recent 8.30% monthly gain, coupled with a 52‑week range that still leaves room for upside, positions it favorably for the upcoming fiscal year. The Chairman’s and CEO’s new holdings could be interpreted as a green light for future capital allocation decisions—potentially including further development or strategic acquisitions. For investors, these insider purchases reinforce confidence in Regency’s long‑term strategy and may justify a buy or hold stance while the company’s real‑estate assets continue to generate steady cash flow.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-02-03 | STEIN MARTIN E JR (Executive Chairman) | Buy | 2,069.00 | N/A | Restricted Stock Grant |

| 2026-02-03 | PALMER LISA (President and CEO) | Buy | 17,934.00 | N/A | Restricted Stock Grant |