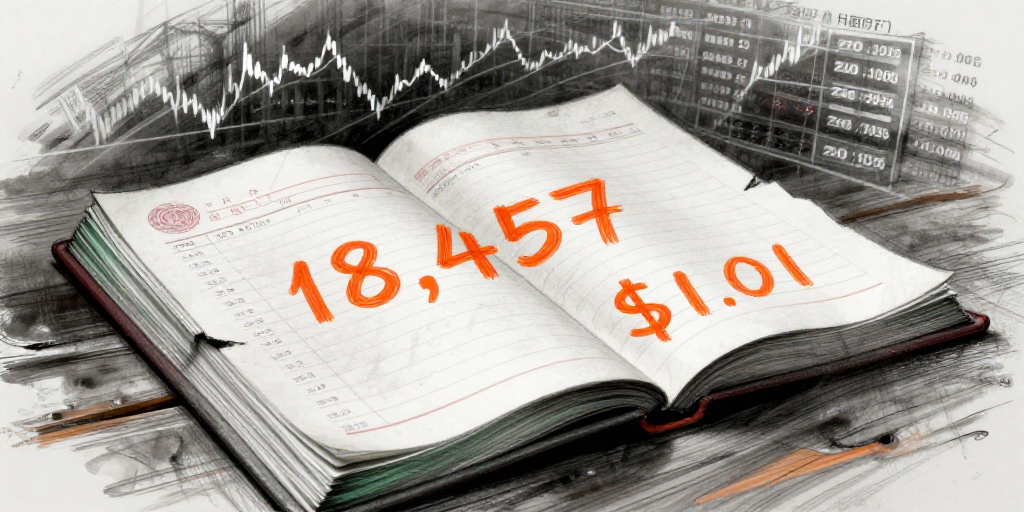

Insider Activity Highlights the Strategic Stakes of Reinsurance Group of America Inc. The latest Form 3 filing by Galvin Cormac, EVP and Head of EMEA, shows no immediate cash trade but a sizable block of 2,467 shares now held as common stock. While the transaction itself is a holding change, it sits alongside a series of derivative‑holding entries—restricted share units and stock‑appreciation rights (SARs) that mature over the next decade. The fact that these instruments are still “in‑flight” signals that Cormac’s compensation package is heavily tied to the company’s long‑term performance, a structure designed to align his incentives with shareholder interests.

What the Derivative Holdings Mean for Investors The derivative entries, ranging from 2018 to 2027, vest in increments and fully mature by the end of 2027. These units will convert to common shares only after the vesting schedule is satisfied, so any dilution will be delayed. For investors, this means that the current market price of $194.84 reflects a relatively low probability of imminent dilution. However, the presence of SARs that settle at a fixed price can create a potential downside if the share price falls below the exercise price, as the company may be compelled to issue new shares at that level. The balance of the derivative portfolio suggests that Cormac’s upside is still largely unrealized, providing a clear incentive for the executive to drive performance over the next few years.

Comparing Cormac’s Position to Company‑Wide Insider Moves In contrast to Cormac’s holding, the recent company‑wide insider activity shows EVP Ronald Herrmann buying and selling nearly 4,000 shares on the same day. Herrmann’s net position remains unchanged, a pattern often seen when insiders exercise options or rebalance portfolios. The absence of any significant buy or sell activity from Cormac during the same period may indicate confidence in the company’s trajectory and a reluctance to alter his stake in the short term. For market participants, this steadiness among senior management can be interpreted as a signal that the company’s leadership believes its strategic plans—particularly in the EMEA region—are on track.

Implications for the Future of RGAA The combination of long‑term derivative holdings and a stable core share position from top executives points to a management team that is committed to long‑term value creation. With a market cap of $12.8 billion and a PE of 15.01, Reinsurance Group of America sits comfortably below its 52‑week high, suggesting there may still be upside potential if the company can continue to execute on its reinsurance strategy. However, investors should monitor the vesting schedule of the SARs closely; any sharp decline in share price could trigger a dilution event that would press the stock down further. Overall, the insider activity paints a cautious but optimistic picture: executives are keeping their hands on the wheel, but their leverage will only materialize over the next few years as the company’s performance unfolds.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| N/A | Galvin Cormac (EVP, Head of EMEA) | Holding | 2,467.00 | N/A | Common Stock |

| 2027-12-31 | Galvin Cormac (EVP, Head of EMEA) | Holding | N/A | N/A | Restricted Share Unit - March 2025 |

| 2035-03-06 | Galvin Cormac (EVP, Head of EMEA) | Holding | N/A | N/A | Stock Appreciation Right (right to purchase) 2025 |

| 2026-12-31 | Galvin Cormac (EVP, Head of EMEA) | Holding | N/A | N/A | Restricted Share Unit - March 2024 |

| 2034-03-15 | Galvin Cormac (EVP, Head of EMEA) | Holding | N/A | N/A | Stock Appreciation Right (right to purchase) 2024 |

| 2025-12-31 | Galvin Cormac (EVP, Head of EMEA) | Holding | N/A | N/A | Restricted Share Unit - March 2023 |

| 2033-03-09 | Galvin Cormac (EVP, Head of EMEA) | Holding | N/A | N/A | Stock Appreciation Right (right to purchase) 2023 |

| 2032-03-22 | Galvin Cormac (EVP, Head of EMEA) | Holding | N/A | N/A | Stock Appreciation Right (right to purchase) 2022 |

| 2031-03-11 | Galvin Cormac (EVP, Head of EMEA) | Holding | N/A | N/A | Stock Appreciation Right (right to purchase) 2021 |

| 2030-03-06 | Galvin Cormac (EVP, Head of EMEA) | Holding | N/A | N/A | Stock Appreciation Right (right to purchase) 2020 |

| 2029-03-01 | Galvin Cormac (EVP, Head of EMEA) | Holding | N/A | N/A | Stock Appreciation Right (right to purchase) 2019 |

| 2028-03-02 | Galvin Cormac (EVP, Head of EMEA) | Holding | N/A | N/A | Stock Appreciation Right (right to purchase) 2018 |