Insider Selling in a Quiet Market

Take‑Two Interactive’s recent 10‑billion‑1‑rule sale by owner Ellen F. Siminoff and her two trusts on January 15, 2026 represents a modest 270‑share divestiture at $245.48 per share. The transaction coincides with a day when the stock was trading just below its 52‑week high, and the market‑wide sentiment remained largely unchanged. For a company that has been quietly building a diversified portfolio of AAA titles and digital‑distribution capabilities, the sale is unlikely to shake investor confidence, especially as it falls within the pre‑planned trading plan adopted in March 2025. However, the timing—just after a modest decline in the broader gaming sector and a slight dip in Take‑Two’s weekly performance—could be interpreted as a liquidity‑driven move rather than a bearish signal.

What It Means for Investors

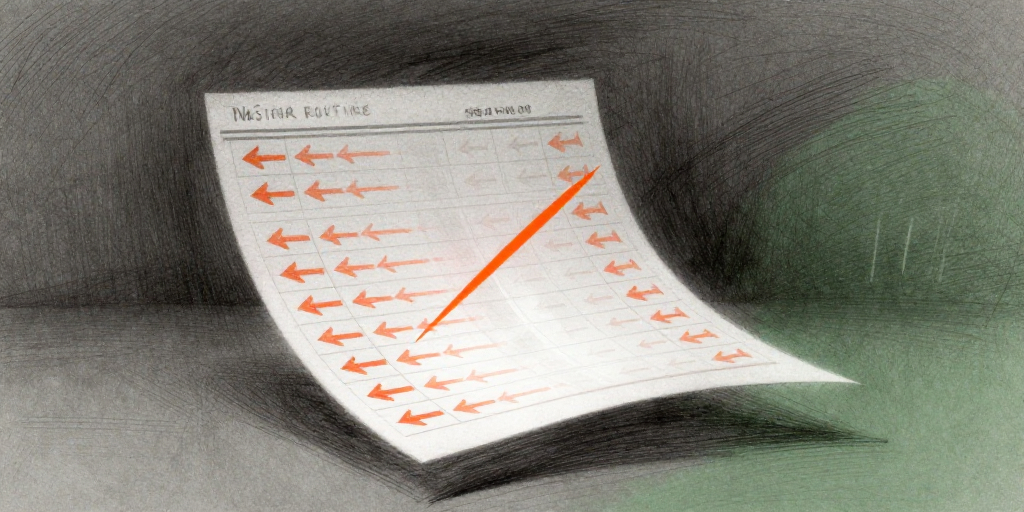

The key question for shareholders is whether this sale signals a shift in management’s outlook. The transaction is small relative to the outstanding share count and does not materially alter the ownership structure. Siminoff’s cumulative holdings, as reflected in the filing, remain above 8 000 shares, a negligible fraction of the 19 million‑plus shares outstanding. Investors should therefore view the sale as routine portfolio rebalancing. In contrast, other insiders such as CFO Lainie Goldstein and legal officer Daniel Emerson have been selling in the thousands, which may hint at broader executive liquidity needs. The pattern of sales—often clustered in October, December, and September—aligns with the typical windows for rule‑based plans, suggesting no urgent distress.

Siminoff’s Trading Profile

A review of Siminoff’s historical transactions shows a consistent pattern of selling around the same time each quarter, with occasional purchases that offset the outflows. In 2025 alone, she sold 1 364 shares in September, 2 381 shares in October, and 3 413 shares in December, while buying 356 shares in August. The average price per share hovered around $240–$260, slightly below the year‑end valuation of $244.34. This disciplined approach indicates a focus on portfolio diversification rather than speculation. Notably, the sale on January 15 mirrors the 10‑billion‑1 rule schedule, reinforcing the view that the transaction is pre‑authorized and not reactionary.

Strategic Context and Forward Outlook

Take‑Two’s recent earnings and analyst upgrades, coupled with institutional inflows such as the Saudi PIF stake transfer, suggest a growing confidence in the company’s long‑term trajectory. The modest insider selling, therefore, is unlikely to offset the positive narrative. Investors may view the transaction as a routine cash‑flow decision that preserves the company’s strategic autonomy while maintaining market stability. The broader insider activity—especially the high‑volume sales by senior executives—merits closer scrutiny, but the overall ownership picture remains intact. As Take‑Two continues to expand its digital distribution ecosystem, the short‑term insider divestitures are unlikely to derail the company’s growth path.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-01-15 | Siminoff Ellen F () | Sell | 270.00 | 245.48 | Common Stock |

| 2026-01-15 | Siminoff Ellen F () | Sell | 144.00 | 245.48 | Common Stock |

| N/A | Siminoff Ellen F () | Holding | 8,351.00 | N/A | Common Stock |