Insider Activity at WisdomTree Signals Strategic Confidence

On January 25, 2026, Chief Information Officer David Yates purchased 22,688 shares of WisdomTree’s common stock, adding to his holdings of 174,811 shares. The transaction, executed at a price of zero because the shares were part of a restricted stock award, coincides with a larger wave of insider buying across the company’s leadership. Chief Executive Officer Jonathan Steinberg and Chief Administrative Officer Peter Ziemba also added tens of thousands of shares, while other executives—such as the Head of Digital Assets and the President & COO—made similar moves. The pattern of purchases, rather than sales, suggests that senior management remains confident in the firm’s trajectory, even as the stock’s recent weekly gain of 6.76% and a 31% monthly rally signal a strong bullish sentiment.

The timing of Yates’ transaction is noteworthy. His award includes a mix of standard restricted shares and performance‑based restricted stock units (PRSUs) slated to vest in 2029. The PRSUs are tied to a total shareholder return benchmark against peer companies, meaning they will convert to common shares only if WisdomTree’s performance exceeds its peers over a three‑year period. By locking in a significant number of shares now, Yates is effectively betting on a continued outperformance of the firm’s asset‑management and digital‑wallet initiatives, both of which are central to WisdomTree’s growth strategy.

From an investor perspective, the insider buying spree can be interpreted as a signal that the company’s top executives are aligned with shareholder interests. The aggregate purchase volume—tens of thousands of shares—represents a meaningful stake in a $2.23 billion market‑cap company. Coupled with the company’s robust 64% year‑to‑date price gain and a price‑earnings ratio of 25.19, the insider activity may help justify a higher valuation, especially as analysts lift price targets in anticipation of forthcoming earnings. However, the 52‑week high of $16.50 and a market cap that is still below the peak valuation of some peers suggest that there is room for further upside, provided the firm can maintain its momentum in both traditional ETFs and its burgeoning blockchain‑native offerings.

Looking ahead, the insider transactions imply a few key themes for WisdomTree’s future. First, the focus on restricted and performance‑based awards indicates that executives are incentivized to deliver long‑term shareholder value, aligning compensation with company performance. Second, the concentration of buying among senior leaders across different functional areas—technology, legal, finance—underscores a cross‑functional commitment to the company’s strategic initiatives, from digital asset development to regulatory compliance. Finally, the high social‑media buzz (699.95% intensity) and positive sentiment (+94) suggest that investors and retail participants are actively discussing the company, which could translate into further demand for the stock as it approaches earnings.

In summary, WisdomTree’s recent insider transactions, led by CIO Yates and echoed by other executives, paint a picture of leadership confidence and a commitment to long‑term growth. For investors, these moves provide an additional layer of assurance that management’s interests are aligned with theirs, while the company’s solid performance metrics and strategic focus on digital assets position it well for the next quarter and beyond.

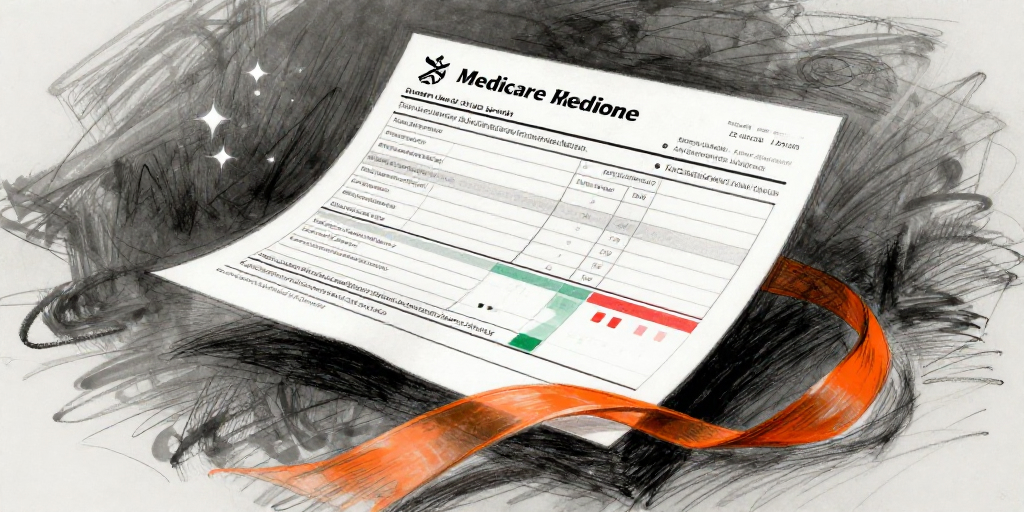

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-01-25 | Yates David M (Chief Information Officer) | Buy | 22,688.00 | 0.00 | Common Stock |

| 2026-01-25 | Yates David M (Chief Information Officer) | Sell | 20,493.00 | 0.00 | Common Stock |

| 2026-01-25 | Yates David M (Chief Information Officer) | Buy | 7,562.00 | 0.00 | Performance Based Restricted Stock Units |

| 2026-01-25 | Ziemba Peter M (Chief Administrative Officer) | Buy | 25,853.00 | 0.00 | Common Stock |

| 2026-01-25 | Ziemba Peter M (Chief Administrative Officer) | Sell | 27,259.00 | 0.00 | Common Stock |

| 2026-01-25 | Ziemba Peter M (Chief Administrative Officer) | Buy | 8,617.00 | 0.00 | Performance Based Restricted Stock Units |

| 2026-01-25 | Steinberg Jonathan L (Chief Executive Officer) | Buy | 121,317.00 | 0.00 | Common Stock |

| 2026-01-25 | Steinberg Jonathan L (Chief Executive Officer) | Sell | 121,651.00 | 0.00 | Common Stock |

| N/A | Steinberg Jonathan L (Chief Executive Officer) | Holding | 798.00 | N/A | Common Stock |

| 2026-01-25 | Steinberg Jonathan L (Chief Executive Officer) | Buy | 121,317.00 | 0.00 | Performance-Based Restricted Stock Units |

| 2026-01-25 | Peck William Bradley (Head of Digital Assets) | Buy | 22,688.00 | 0.00 | Common Stock |

| 2026-01-25 | Peck William Bradley (Head of Digital Assets) | Sell | 21,713.00 | 0.00 | Common Stock |

| 2026-01-25 | Peck William Bradley (Head of Digital Assets) | Buy | 7,562.00 | 0.00 | Performance Based Restricted Stock Units |

| 2026-01-25 | Marinof Alexis (CEO, Europe) | Buy | 44,331.00 | 0.00 | Common Stock |

| 2026-01-25 | Marinof Alexis (CEO, Europe) | Sell | 33,432.00 | 0.00 | Common Stock |

| 2026-01-25 | Marinof Alexis (CEO, Europe) | Buy | 14,777.00 | 0.00 | Performance Based Restricted Stock Units |

| 2026-01-25 | Lilien R Jarrett (President and COO) | Buy | 71,351.00 | 0.00 | Common Stock |

| 2026-01-25 | Lilien R Jarrett (President and COO) | Sell | 70,932.00 | 0.00 | Common Stock |

| 2026-01-25 | Lilien R Jarrett (President and COO) | Buy | 71,351.00 | 0.00 | Performance Based Restricted Stock Units |

| 2026-01-25 | Frankenthaler Marci (Chief Legal Officer) | Buy | 31,612.00 | 0.00 | Common Stock |

| 2026-01-25 | Frankenthaler Marci (Chief Legal Officer) | Sell | 25,134.00 | 0.00 | Common Stock |

| 2026-01-25 | Frankenthaler Marci (Chief Legal Officer) | Buy | 10,537.00 | 0.00 | Performance Based Restricted Stock Units |

| 2026-01-25 | Edmiston Bryan (Chief Financial Officer) | Buy | 36,048.00 | 0.00 | Common Stock |

| 2026-01-25 | Edmiston Bryan (Chief Financial Officer) | Sell | 25,965.00 | 0.00 | Common Stock |

| 2026-01-25 | Edmiston Bryan (Chief Financial Officer) | Buy | 12,016.00 | 0.00 | Performance Based Restricted Stock Units |