Insider Selling Frenzy at XCF Global Inc.

XCF Global Inc. has experienced a sudden spike in insider selling over the past week. Owner SOULE RANDY sold a total of 1.1 million shares between January 8 and 12, 2026, dropping his holdings from 78.7 million to 77.6 million shares. The sales were conducted at a price that hovered around $0.16–$0.17 per share, just above the daily close of $0.167. This activity coincided with a 19 % weekly decline and a staggering 56 % monthly drop, underscoring a period of intense volatility for the company’s stock.

Implications for Investors

The bulk of the sales occurred in a single day on January 9, when RANDY liquidated 800,000 shares at a price roughly 2 % below market. Such concentrated selling can signal a lack of confidence among insiders, potentially eroding investor sentiment at a time when the stock is already trading near its 52‑week low. The high social‑media buzz (over 2,200 % intensity) suggests that retail investors are highly attentive to this drama; if the narrative turns negative, the price could spiral downward further. Conversely, if the sales are viewed as a strategic realignment—perhaps to fund a new project or to rebalance a portfolio—then the narrative might soften. In either case, the timing and volume of these transactions will be a key barometer for market watchers.

What It Means for XCF’s Future

XCF is in the midst of a strategic overhaul: a new CFO, the launch of a SAF facility, and discussions with Bank of America for debt structuring. The insider selling could be interpreted as a liquidity maneuver to support these capital‑intensive initiatives, or as a warning sign that key executives doubt the company’s near‑term prospects. For shareholders, the question is whether the company can convert its low market cap ($30.7 m) and low P/E (0.416) into sustainable revenue growth. The recent CFO appointment and potential financing for the Reno 2 SAF plant suggest that management is intent on scaling, but the insider sell‑off injects caution into that optimism.

A Profile of SOULE RANDY

Rand y’s historical record shows a single holding of 7.95 million shares, indicating that he has not been a frequent trader. His recent activity—selling 1.1 million shares in a compressed timeframe—represents an unusually aggressive exit relative to his typical behavior. The absence of a formal title in the filing suggests he may be a significant shareholder or a board member. If this sale pattern repeats, it could indicate a shift in his investment thesis or a strategic move to free up capital for other ventures. For analysts, RANDY’s actions warrant close scrutiny: a single insider can carry substantial weight in a company of XCF’s scale.

Bottom Line for Investors

The combination of a sharp insider sell‑off, a weak price trajectory, and a high‑buzz social media environment creates a volatile mix. While the company’s leadership is actively pursuing expansion and financing, the insider activity may dampen short‑term sentiment. Investors should monitor both the underlying fundamentals—particularly the SAF pipeline—and the timing of future insider transactions before deciding on a position.

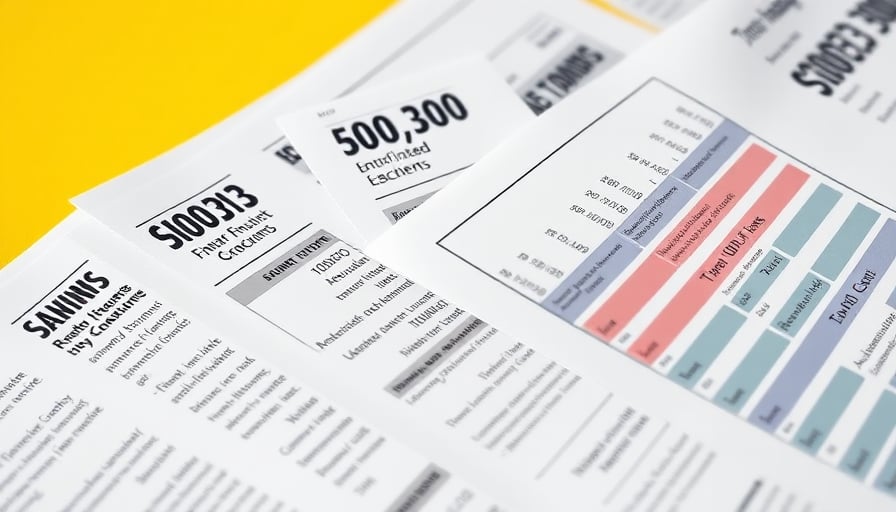

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026-01-08 | SOULE RANDY () | Sell | 200,000.00 | 0.17 | Class A Common Stock |

| 2026-01-09 | SOULE RANDY () | Sell | 200,000.00 | 0.16 | Class A Common Stock |

| 2026-01-09 | SOULE RANDY () | Sell | 200,000.00 | 0.16 | Class A Common Stock |

| 2026-01-09 | SOULE RANDY () | Sell | 200,000.00 | 0.16 | Class A Common Stock |

| 2026-01-12 | SOULE RANDY () | Sell | 73,000.00 | 0.15 | Class A Common Stock |

| 2026-01-12 | SOULE RANDY () | Sell | 200,000.00 | 0.16 | Class A Common Stock |

| 2026-01-12 | SOULE RANDY () | Sell | 200,000.00 | 0.16 | Class A Common Stock |