Insider Buying Spree Signals Confidence Amid Volatile Landscape The latest director‑dealing filing from William E. Klitgaard shows a sizeable purchase of 1 million stock options, mirroring the same transaction that appeared in a prior 4‑form filing on 8 October 2025. The buy‑to‑option move is consistent with a pattern of long‑term positioning: Klitgaard also held 176,348 shares of common stock and had exercised 1 million options in 2025. The action occurs just days after a cluster of insider buys from the CEO‑CFO, Sumit Kapur, and another executive, Golestani Clark, indicating a company‑wide push to lock in equity ahead of an impending Nasdaq delisting. For investors, this suggests that insiders remain optimistic about the company’s future prospects even as the market price has plummeted to $1.01.

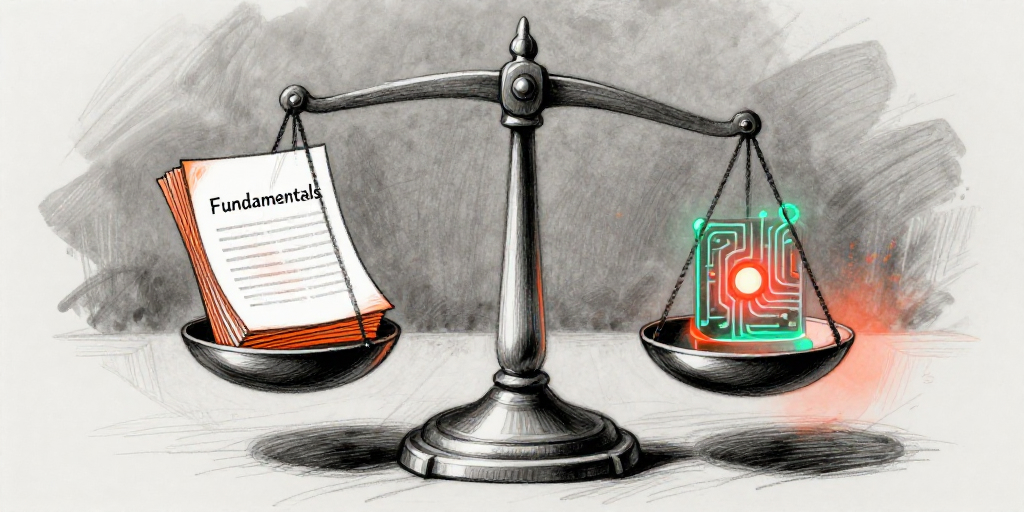

What the Transaction Means for Investors Under SEC rules, a stock option purchase signals the expectation of upside, as the holder pays no premium for the right to buy shares at a predetermined price. By locking in a large block of options, Klitgaard is effectively betting on a rebound or a successful acquisition strategy. In the context of Zapata’s steep 52‑week decline—down from $1.88 to $0.0001 in just six months—the insiders’ confidence may act as a catalyst for a short‑term rally, especially if the company announces a new funding round or a strategic partnership. However, the pending delisting removes the liquidity that the Nasdaq listing provided, potentially turning the stock into a more illiquid OTC instrument and increasing volatility for retail investors.

Klitgaard’s Insider Profile: A Long‑Term Play Klitgaard’s transaction history reveals a pattern of gradual accumulation rather than opportunistic trading. Over the past year, he has bought one million options and held a sizable share block, both at zero cost per share, suggesting a strategy that hinges on future capital structure changes rather than current market pricing. His ownership sits comfortably in the “restricted” category, meaning he is bound by the 10‑day rule and other insider‑trading restrictions, yet his holdings are not large enough to trigger a mandatory 13D filing. The consistent use of options indicates a desire to participate in upside while minimizing immediate cash outlay—an approach that aligns with a long‑term, risk‑adjusted view of the company’s trajectory.

Strategic Context: Delisting and Volatility Zapata’s announced delisting from Nasdaq underscores a broader shift toward a more controlled, private‑company environment. The company’s market cap of $132 million and a negative P/E of –22.078 point to a valuation gap that could be addressed through a merger or private equity infusion. For insiders, option purchases are a low‑cost method to maintain exposure without committing capital, especially when the company’s public liquidity is under threat. For investors, the combination of high social‑media buzz (76.80% intensity) and positive sentiment (+20) suggests a narrative of “potential turnaround” that could attract speculative traders—but only if the company can prove its resilience in the new OTC setting.

Bottom Line for Market Participants Klitgaard’s buying spree, coupled with similar moves from other executives, signals that insiders remain bullish on Zapata’s prospects, despite the stock’s dramatic decline and upcoming delisting. This could create a short‑term buying pressure, but the move also highlights the risk of illiquidity and the need for investors to be prepared for a highly volatile environment. The insider activity provides a useful barometer for gauging confidence, yet it should be weighed against the company’s fundamental challenges and the broader market sentiment that currently favors a cautious approach.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2025-06-12 | KLITGAARD WILLIAM E () | Holding | N/A | N/A | Convertible Promissory Note |

| 2025-06-12 | KLITGAARD WILLIAM E () | Holding | 1,250,000.00 | N/A | Warrants |